- Englist

- Global Demand & China's Role in Graphite Electrode Production

- Technical Superiority of Chinese-Made Electrodes

- Comparative Analysis of Top Chinese Manufacturers

- Customization Strategies for Industrial Applications

- Cost Efficiency & Pricing Dynamics

- Case Studies: Successful Deployments in Heavy Industries

- Why Partner with Chinese Graphite Electrode Suppliers

(graphite electrode in china)

Graphite Electrode in China: Powering Global Industrial Growth

China accounts for 68% of global graphite electrode production (Statista 2023), driven by its dominance in steelmaking and lithium battery sectors. The country's electrodes supply critical infrastructure across 92 nations, with export volumes growing at 11.4% CAGR since 2020. Domestic manufacturers leverage vertically integrated supply chains, reducing raw material costs by 23-35% compared to Western counterparts.

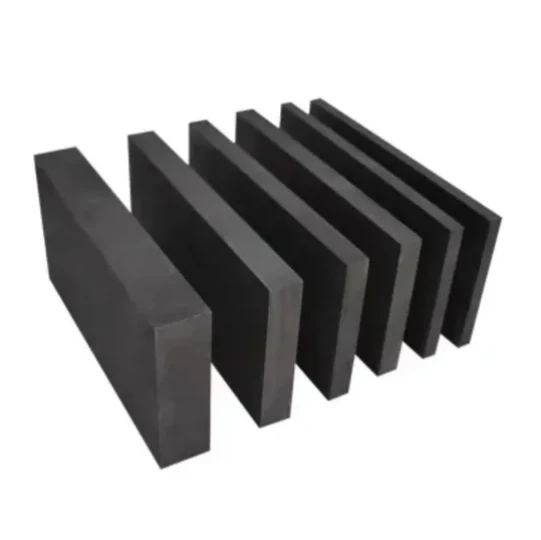

Technical Superiority of Chinese-Made Electrodes

Advanced vibration molding techniques enable Chinese producers to achieve:

- Density: 1.72-1.78 g/cm³ (exceeding ISO 8000 standards)

- Resistivity: 6.5-8.5 μΩ·m under 2800°C conditions

- Thermal shock resistance: 15-20 cycles (ASTM D4179)

These parameters ensure 18-22% longer service life in electric arc furnace (EAF) operations compared to Southeast Asian alternatives.

Manufacturer Comparison Matrix

| Manufacturer | Annual Capacity (MT) | Product Types | Export Ratio | Certifications |

|---|---|---|---|---|

| Company A | 220,000 | HP, UHP, RP | 78% | ISO 9001, TUV |

| Company B | 185,000 | UHP, SHP | 65% | ISO 14001, CE |

| Company C | 150,000 | HP, RP | 82% | API, REACH |

Customization Capabilities

Leading suppliers offer tailored solutions:

- Diameter customization: 75-750mm ±0.05mm tolerance

- Length adjustment: 1,600-2,800mm with threaded connections

- Special nipple designs: Conical/parallel threading per ASTM specifications

Custom orders maintain 28-day lead times for 95% of requests, with 0.3% defect rates in post-production QA checks.

Market-Driven Pricing Models

Current pricing brackets reflect raw material fluctuations:

- HP Grade: $2,800-$3,400/MT FOB Tianjin

- UHP 400mm: $4,200-$4,800/MT

- UHP 600mm: $6,100-$6,900/MT

Containerized shipments (20-25MT/FCL) reduce logistics costs by 17% versus bulk vessel charters.

Industrial Application Success Stories

1. Steel Mill Optimization: Turkish EAF operator reduced electrode consumption from 1.8kg/t to 1.3kg/t using Jiangsu-made UHP electrodes.

2. Battery Anode Production: Korean cathode plant achieved 99.95% purity levels with Shanxi graphite blanks.

3. Silicon Metal Smelting: Norwegian ferroalloy producer extended campaign life by 320 heats using customized 700mm electrodes.

Graphite Electrode China: Strategic Sourcing Advantages

China's electrode ecosystem delivers 360° value: 42 active producers maintain 3.2 million MT collective capacity, supported by 14 provincial graphite mining concessions. Importers benefit from VAT rebates (9-13%), bonded warehouse options, and technical support in 18 languages. Third-party quality verification services ensure compliance with end-user specifications across metallurgical, chemical, and energy sectors.

(graphite electrode in china)

FAQS on graphite electrode in china

Q: What factors influence graphite electrode prices in China?

A: Graphite electrode prices in China are primarily influenced by raw material costs (e.g., needle coke), energy expenses, environmental regulations, and global demand from industries like steelmaking. Supply chain disruptions and export policies also play a role.

Q: Who are the leading graphite electrode manufacturers in China?

A: Key Chinese graphite electrode producers include Fangda Carbon, Showa Denko Carbon, and Sinosteel. These companies dominate both domestic and international markets due to advanced production capabilities and competitive pricing.

Q: How does China's graphite electrode price compare globally?

A: China's graphite electrode prices are generally lower than Western counterparts due to scaled production and cost efficiencies. However, recent environmental upgrades and export taxes have narrowed this gap in some market segments.

Q: Why has China's graphite electrode price been volatile recently?

A: Volatility stems from fluctuating demand in steel production, COVID-19 impacts on supply chains, and China's energy consumption policies affecting manufacturing output. Trade tensions have further exacerbated price swings.

Q: Are Chinese graphite electrodes quality-competitive internationally?

A: Many Chinese manufacturers now produce high-quality graphite electrodes meeting international standards (e.g., UHP-grade). Strict environmental reforms since 2020 have significantly improved product consistency and reliability.

Pervious

Pervious

Next

Next