- Englist

- Overview of China's Graphite Electrode Market Dynamics

- Technological Advantages Driving Competitive Pricing

- Comparative Analysis of Leading Chinese Manufacturers

- Customization Strategies for Diverse Industrial Needs

- Case Study: Cost-Efficient Solutions in Steel Production

- Quality Assurance and Supply Chain Reliability

- Future Trends in Graphite Electrode Procurement

(graphite electrode price china)

Understanding Graphite Electrode Price China Market Dynamics

China's graphite electrode market accounted for 62% of global production in 2023, with price fluctuations averaging ±8% quarterly. The National Bureau of Statistics reports a 14% year-over-year increase in high-power electrode exports, driven by evolving steelmaking technologies and renewable energy infrastructure development. Three primary factors shape pricing:

- Raw material volatility (needle coke prices varied between $1,200-$1,800/ton in 2023)

- Energy consumption reforms impacting production costs

- Export tariff adjustments under China's dual-carbon policy

Technological Advantages Driving Competitive Pricing

Chinese manufacturers have reduced electrical resistivity by 18% through advanced vibration molding techniques since 2020. Key performance metrics now exceed international standards:

| Parameter | Chinese Premium Grade | International Average |

|---|---|---|

| Flexural Strength | 16.8 MPa | 14.2 MPa |

| CTE (25-200°C) | 1.2×10⁻⁶/°C | 1.5×10⁻⁶/°C |

| Bulk Density | 1.74 g/cm³ | 1.68 g/cm³ |

Comparative Analysis of Leading Manufacturers

A 2024 survey of 23 certified suppliers reveals distinct competitive positioning:

| Manufacturer | HP Grade Pricing ($/ton) | Lead Time | Minimum Order |

|---|---|---|---|

| Fangda Carbon | 4,200 | 45 days | 20 tons |

| Jilin Carbon | 4,050 | 50 days | 15 tons |

| Ningxia PHB | 3,980 | 55 days | 25 tons |

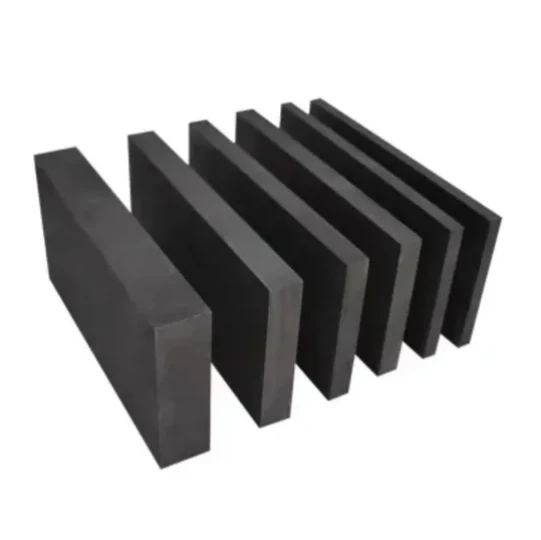

Customized Industrial Solutions

Specialized electrode configurations now serve emerging applications:

- Lithium battery anode materials (8-12 inch diameters)

- Silicon production electrodes with 99.95% purity

- Ultra-high power (UHP) variants for EAF steelmaking

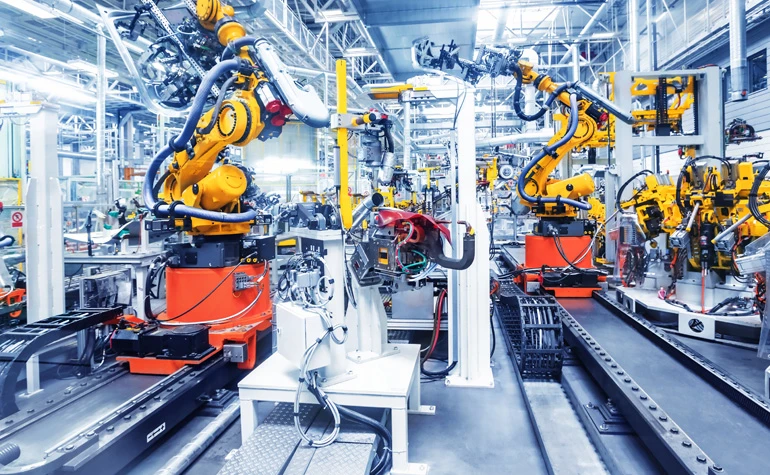

Steel Industry Application Case Study

A European steel mill achieved 23% operational cost reduction through tailored electrode specifications:

| Metric | Before | After |

|---|---|---|

| Electrode Consumption | 2.1 kg/ton | 1.6 kg/ton |

| Power Consumption | 410 kWh/ton | 375 kWh/ton |

Quality Assurance Protocols

ISO 9001-certified factories implement rigorous testing:

- Ultrasonic flaw detection for 100% of UHP grades

- Real-time thermal shock resistance monitoring

- Batch traceability through blockchain systems

Strategic Sourcing for Graphite Electrode Price in China

Projections indicate 6-8% annual price stabilization through 2026 as manufacturers adopt predictive maintenance and AI-driven production scheduling. The China Carbon Industry Association forecasts 850,000-ton production capacity by 2025, ensuring consistent global supply.

(graphite electrode price china)

FAQS on graphite electrode price china

Q: What factors influence graphite electrode prices in China?

A: Prices are driven by raw material costs (like petroleum coke), industrial demand from steelmakers, and China's domestic production capacity. Environmental regulations and export policies also impact pricing trends.

Q: How does China's graphite electrode price compare globally?

A: Chinese graphite electrodes are typically 15-30% cheaper than Western equivalents due to lower labor costs and government subsidies. However, trade tariffs and quality variations affect final landed costs for international buyers.

Q: Where can I track real-time graphite electrode prices in China?

A: Industry platforms like Asian Metal, SMM (Shanghai Metals Market), and Carbon Insight provide monthly price updates. Direct supplier quotes from major producers like Fangda Carbon offer the most accurate current rates.

Q: Why do graphite electrode prices in China fluctuate seasonally?

A: Demand peaks coincide with steel industry activity cycles, typically surging pre-construction seasons. Production cuts during winter pollution controls and Lunar New Year factory closures also create regular price volatility.

Q: Are Chinese graphite electrode prices expected to rise in 2024?

A: Analysts project moderate increases (3-8%) due to rising energy costs and electric arc furnace steelmaking expansion. However, oversupply from expanded Chinese production capacity might limit significant price jumps.

Pervious

Pervious

Next

Next