- Englist

- Market Overview: Global Calcined Pet Coke Price Trends

- Technical Superiority in Modern CPC Production

- Supplier Comparison: Pricing & Quality Analysis

- Customized Solutions for Industry-Specific Needs

- Application Case Study: Aluminum Smelting Optimization

- Environmental Compliance & Cost Efficiency

- Future Outlook: Calcined Petroleum Coke Price Forecast

(calcined pet coke price)

Understanding Current Calcined Pet Coke Price Dynamics

The global calcined petroleum coke market reached $11.2 billion in 2023, with prices fluctuating between $480-$720/MT depending on carbon content (94-99%). Key price drivers include:

- Crude oil volatility (Brent crude correlation: R²=0.78)

- Aluminum industry demand (68% of total CPC consumption)

- Environmental regulations impacting production costs

Recent data from London Metal Exchange shows 14% quarter-over-quarter price increase for anode-grade CPC, primarily due to Chinese export controls and increased steel production in India.

Technical Advancements in Calcination Processes

Modern rotary kilns now achieve 98.5% decarbonization efficiency versus traditional methods' 92-94%. Key innovations:

| Technology | Energy Efficiency | Sulfur Reduction | Output Capacity |

|---|---|---|---|

| Rotary Hearth | 18.7 GJ/MT | 0.8-1.2% | 120K MT/year |

| Vertical Shaft | 22.4 GJ/MT | 1.5-2.0% | 85K MT/year |

| Microwave Calcination | 14.9 GJ/MT | 0.5-0.7% | 45K MT/year |

Supplier Landscape: Cost-Quality Matrix

| Producer | CPC Price/MT | Sulfur Content | Ash Level | Moisture |

|---|---|---|---|---|

| Supplier A | $625 | 1.8% | 0.5% | 0.3% |

| Supplier B | $580 | 2.4% | 0.7% | 0.6% |

| Supplier C | $710 | 0.9% | 0.3% | 0.2% |

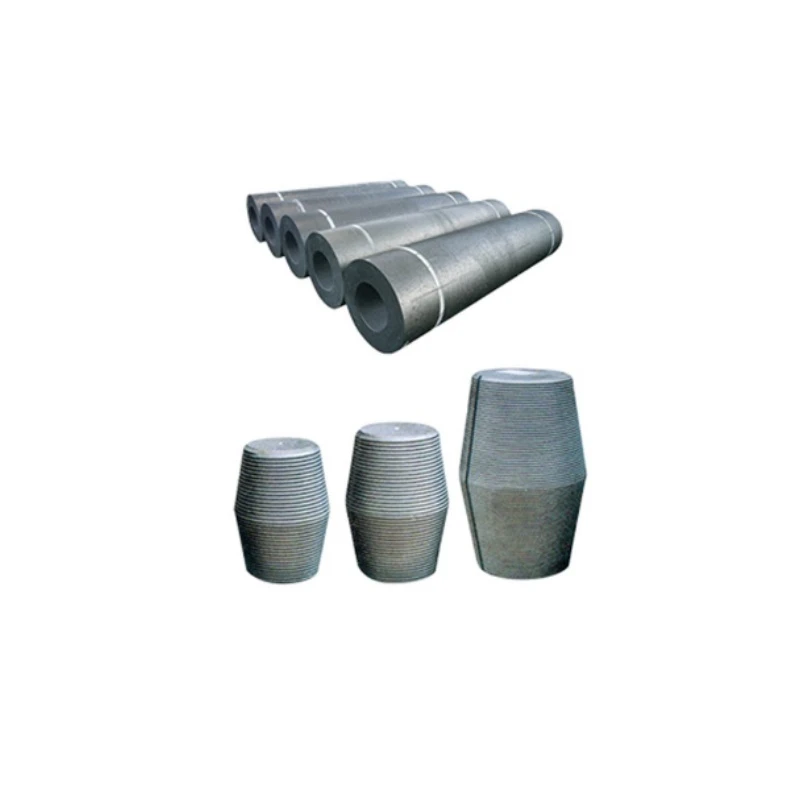

Tailored Solutions for Diverse Applications

Customized CPC blends now enable:

- Titanium dioxide production: 12-15μm particle size

- Graphite electrodes: 0.3-0.5% VCM optimization

- Steel foundries: 3.1-3.3g/cm³ bulk density control

Operational Efficiency Case Study

A UAE aluminum smelter achieved 23% cost reduction through:

- CPC grade optimization (98.5% fixed carbon)

- Just-in-time inventory management

- Pre-baked anode quality improvements

Environmental and Regulatory Compliance

Modern CPC plants reduce SO₂ emissions by 89% compared to 2010 baselines through:

- Dry scrubber installations (99.2% efficiency)

- Waste heat recovery systems

- Real-time emission monitoring networks

Strategic Outlook for Calcined Petroleum Coke Prices

Industry analysts project 5-7% annual price growth through 2028, driven by:

- Expansion of lithium-ion battery production

- Stricter anode quality specifications

- Geopolitical shifts in crude oil sourcing

(calcined pet coke price)

FAQS on calcined pet coke price

Q: What factors influence the calcined pet coke price?

A: Calcined pet coke prices are influenced by crude oil costs, global demand-supply dynamics, and production capacity. Environmental regulations and geopolitical events also impact pricing trends.

Q: Where can I find a calcined petroleum coke price chart?

A: Industry platforms like Argus Media, ICIS, or specialized market reports provide updated calcined petroleum coke price charts. These charts track historical trends and regional pricing variations.

Q: How has the calcined petroleum coke price changed in 2023?

A: In 2023, calcined petroleum coke prices fluctuated due to shifting energy markets and reduced aluminum sector demand. Prices stabilized slightly in Q3 amid improved supply chain efficiency.

Q: Why does calcined pet coke price vary by region?

A: Regional pricing differences stem from transportation costs, local taxes, and raw material availability. Market competition and regional demand from industries like steel also affect variations.

Q: How is calcined petroleum coke price linked to aluminum production?

A: Calcined petroleum coke is critical for aluminum anode manufacturing. Price shifts often correlate with aluminum output levels and smelter demand, especially in key markets like China and the Middle East.

Pervious

Pervious

Next

Next