- Englist

- Market Overview and Data Insights on Calcined Petcoke

- Technical Advantages in Modern Industrial Processing

- Manufacturer Comparison: Key Industry Players

- Customized Solutions for Specific Industrial Needs

- Practical Applications Across Key Industries

- Pricing Structures and Market Dynamics

- Strategic Considerations for Calcined Petroleum Coke Procurement

(calcined petcoke)

Understanding Global Calcined Petcoke Supply and Demand Metrics

Global calcined petroleum coke consumption reached 15.2 million metric tons in 2023, with the aluminum industry accounting for over 65% of total demand. Market analysis indicates steady 4.3% CAGR growth through 2028, driven primarily by expanding smelting operations across Asia-Pacific regions. Current global production capacity exceeds 18 million tons annually, creating competitive dynamics across key markets.

Quality specifications continue to tighten across major sectors, with sulfur content emerging as a critical differentiator. Premium-grade CPC now maintains maximum sulfur thresholds below 2.0%, while standard grades operate within 3.0-3.5% parameters. Carbon content remains non-negotiable across all grades, maintaining minimum benchmarks of 98.5% purity.

Processing Advantages Transforming Industrial Applications

Advanced rotary kiln technologies now achieve 94-97% volatile matter removal efficiency, exceeding previous industry standards by 8-12%. Modern facilities incorporate preheating recovery systems capturing up to 40% of thermal energy traditionally wasted during calcination. These technical improvements significantly reduce production costs while enhancing carbon crystal structure development.

The latest emission control systems meet stringent environmental regulations, capturing 99.7% of particulate matter. Continuous real-time monitoring has become standard practice across certified manufacturers. Process automation improvements deliver batch consistency within ±0.35% carbon content variance. Such precision ensures reliable anode performance in critical applications.

Comparative Performance Metrics Across Manufacturers

| Manufacturer | Sulfur Content (%) | Real Density (g/cm³) | Production Capacity (kMT/year) | Moisture Content (%) |

|---|---|---|---|---|

| Global Source A | 1.8-2.2 | 2.07-2.09 | 2,500 | 0.10-0.15 |

| Reliable Supplier B | 2.3-2.6 | 2.05-2.07 | 1,800 | 0.15-0.25 |

| Premium Producer C | 1.5-1.9 | 2.08-2.11 | 1,200 | 0.08-0.12 |

| Regional Supplier D | 3.0-3.4 | 2.03-2.05 | 850 | 0.20-0.35 |

Leading producers maintain distinct competitive advantages. Those with integrated supply chains demonstrate significantly lower product variance while suppliers with dedicated port facilities achieve 15-20% logistics cost advantages. Production scale directly correlates with consistency metrics, with facilities exceeding 500kMT/year capacity demonstrating measurably tighter specification adherence.

Tailored Solutions for Industry-Specific Requirements

Titanium dioxide pigment manufacturers require specialized CPC formulations achieving 99.5% minimum carbon purity with controlled vanadium levels below 300ppm. Dedicated production lines now deliver optimized crystal structures enhancing chloride reaction kinetics. Steel foundries increasingly utilize custom-designed CPC blends replacing traditional anthracite, reducing electrode consumption by 11-18%.

Leading aluminum smelters partner with CPC producers to develop application-specific formulations. Strategic collaborations have yielded proprietary anode grade cokes reducing specific consumption by 1.8-2.5%. These specialized products command premium calcined petroleum coke prices averaging 12-18% above standard market rates due to measurable operational benefits.

Implementation Case Studies in Core Industries

A Norwegian aluminum smelter achieved 4.7% reduction in specific anode consumption through implementing a customized ultra-low sulfur CPC formulation. This translated to annual savings exceeding $7.2 million despite the premium calcined petcoke

prices associated with specialized grades. The plant concurrently reduced fluoride emissions by optimizing anode performance characteristics.

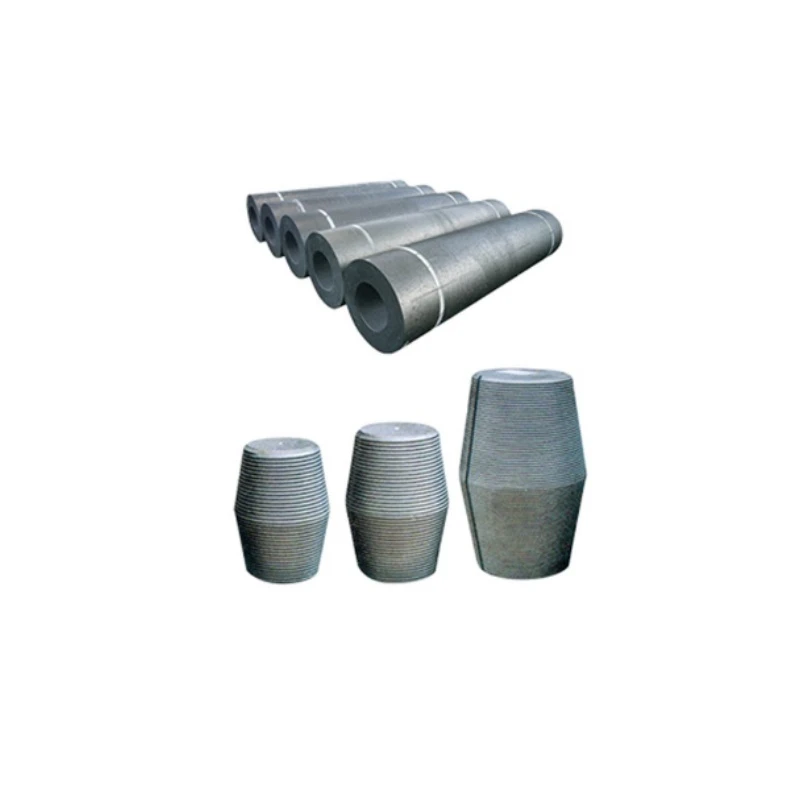

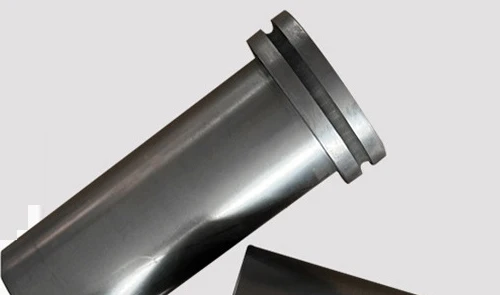

Specialty graphite electrode manufacturers successfully transitioned to CPC blends optimized for electrical conductivity properties. The reformulated production material delivered 14% longer continuous operation cycles between electrode replacements. Quality certifications significantly improved, with graphite density consistency improving by 22% across production batches after the transition.

Analyzing Current Calcined Petcoke Price Structures

Current FOB Gulf Coast pricing for standard grade calcined petroleum coke fluctuates between $450-$520 per metric ton, influenced by crude oil volatility. Contract terms increasingly incorporate quarterly adjustment mechanisms linked to petroleum indexes. Premium low-sulfur grades command substantial differentials, with contract values currently ranging between $580-$680/MT for specialized anode-grade material.

Logistics represent 15-30% of total landed costs, creating distinct regional pricing variations. Southeast Asian importers currently pay $50-$75/MT premiums over Persian Gulf benchmarks due to shipping constraints. Market experts project continued price stratification, with high-purity material maintaining substantial differentials through 2025.

Strategic Procurement Planning for Calcined Petroleum Coke

Optimizing calcined petcoke procurement requires comprehensive technical evaluations beyond basic price comparisons. Progressive buyers now establish integrated qualification programs assessing multiple parameters including crystalline structure analysis and reactivity performance. Leading industrial consumers maintain diversified supplier portfolios to ensure consistent quality across production cycles.

Long-term agreements with flexible volume commitments provide significant calcined petcoke price stability. The most successful procurement strategies incorporate 12-24 month supply arrangements with index-linked pricing components. This approach balances price visibility with necessary flexibility while ensuring consistent quality standards essential for modern industrial applications.

(calcined petcoke)

FAQS on calcined petcoke

-

Q: What is calcined petcoke used for?

A: Calcined petcoke primarily serves as a carbon source in the production of aluminum anodes and steel electrodes. It is essential for smelting processes due to its high carbon content and low impurities. Additionally, it finds use in titanium dioxide manufacturing and as a recarburizer in steelmaking.

-

Q: What drives calcined petcoke prices?

A: Crude oil costs directly impact raw material expenses for calcined petcoke production. Global demand from aluminum and steel industries significantly influences market rates too. Supply disruptions and environmental regulations in key producing regions also cause price volatility.

-

Q: Where can I track calcined petroleum coke price trends?

A: Commodity platforms like Argus Media or S&P Global Platts provide regular calcined petroleum coke price reports. Industry publications and direct supplier quotes are also reliable sources for current pricing. Market analysis firms further offer forecasts based on global supply-demand dynamics.

-

Q: How does quality affect calcined petcoke prices?

A: Higher purity (99%+ carbon) and lower sulfur/ash content command premium calcined petcoke prices due to superior performance in smelting. Metallurgical-grade coke typically costs more than fuel-grade variations. Specific size consistency and porosity standards also contribute to value differentiation.

-

Q: What are current calcined petcoke market dynamics?

A: Demand remains strongest in Asia-Pacific regions with growing aluminum production capacities. Supply shifts occur with refinery operations affecting green coke availability. Environmental policies pushing cleaner industrial alternatives create long-term pricing pressures across the sector.

Pervious

Pervious

Next

Next