- Englist

- Introduction to refinery-derived calcined petroleum coke

- Industrial significance and market data

- Manufacturing process and quality parameters

- Leading global suppliers comparison

- Specialized solutions for different industries

- Industrial implementation case studies

- Strategic importance in modern refining

(calcined petroleum coke from a refinery)

Understanding Calcined Petroleum Coke from a Refinery

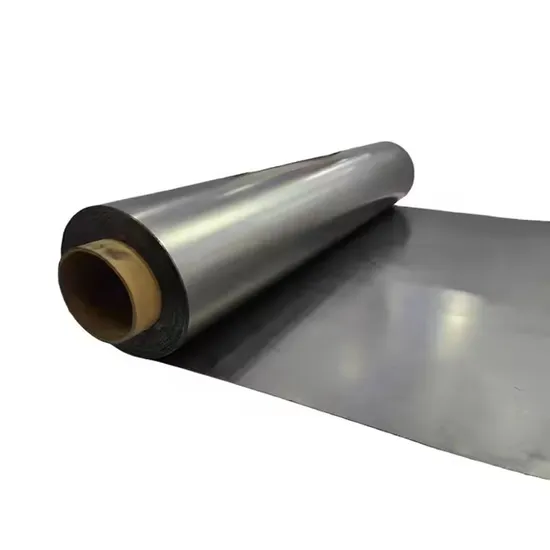

Refinery-sourced calcined petroleum coke (CPC) represents a critical industrial material derived from delayed coker units during crude oil processing. This specialized carbon product undergoes thermal treatment at 1200-1350°C to remove volatile components and develop the crystalline structure necessary for demanding applications. Petroleum coke refineries transform residual hydrocarbons into this valuable anode-grade carbon material through a carefully controlled calcination process that modifies electrical conductivity and physical density, making it indispensable for modern metallurgical processes.

Market Position and Performance Metrics

Global CPC markets exhibit robust growth, with projections indicating a 5.8% CAGR through 2028. Current production exceeds 15 million metric tons annually, with aluminum smelting consuming approximately 75% of worldwide supply. China dominates manufacturing with 58% market share, though North American facilities demonstrate superior consistency in sulfur content management, maintaining levels below 2.5% versus the global average of 3.1%. The sector's valuation surpassed $12 billion in 2023 despite supply chain disruptions that temporarily increased transportation costs by 22% for international shipments.

Manufacturing Technology and Quality Specifications

The calcination process employs rotary or shaft kilns with proprietary thermal profiling techniques to achieve optimal real density (1.98-2.08 g/cm³) and specific electrical resistance (500-550 μΩm). Advanced refineries implement continuous emission monitoring systems to maintain particulate emissions below 20mg/Nm³. Quality is controlled through eight critical parameters, including:

- Carbon content: >98.5% for anode-grade CPC

- Sulfur specification: ≤3.0% for standard aluminum applications

- Moisture retention: <0.5% after processing

- Vibrated bulk density: 0.80-0.88 g/cm³

Global Manufacturing Analysis

Top-tier calcined petroleum coke manufacturers maintain operations across strategic refining locations to serve regional markets. Capacity distribution varies significantly, with distinct quality differentials:

| Manufacturer | Annual Capacity (MT) | Primary Markets | Key Product Characteristics |

|---|---|---|---|

| Oxbow Carbon | 2.2 million | Americas, Europe | Low-sulfur CPC (<1.8%) |

| Rain Industries | 1.9 million | Asia, Middle East | High-density grade (2.05 g/cm³) |

| Aluminium Bahrain | 1.1 million | GCC, Southeast Asia | Ultra-low vanadium CPC |

| Shandong KeYu Energy | 0.85 million | China, Domestic | Standard anode-grade CPC |

Industry-Specific Processing Solutions

Petroleum coke refineries increasingly provide customized blends optimized for specific applications. Steel manufacturers require CPC with 68-72% fixed carbon for recarburization, while premium titanium dioxide production demands nickel and vanadium concentrations below 300ppm. Dedicated low-sulfur formulations (<1.5%) serve lithium-ion battery anode markets, commanding premium pricing averaging 18-22% above standard CPC. Refinery providers achieve this through crude selection protocols and specialized conditioning processes that alter the porosity distribution to meet exact client specifications.

Application Case Studies

A Middle Eastern aluminum smelter achieved 9% power consumption reduction by switching to specialized CPC with optimized crystalline structure, lowering resistance in anode blocks. This translated to $32/MT savings across 250,000 MT annual production. In Scandinavia, a graphite electrode manufacturer resolved cracking issues by adopting a nickel-restricted CPC grade (<150ppm), improving yield by 11%. Meanwhile, a North American silicone producer utilized low-ash CPC to enhance reaction efficiency in metallurgical silicon synthesis, increasing furnace campaign life by 22% and reducing refractory replacement costs.

The Strategic Position of Calcined Petroleum Coke in Modern Refining

Calcined petroleum coke remains indispensable to industrial value chains originating from petroleum coke refineries. As metallurgical and chemical processes evolve toward greater efficiency requirements, manufacturers continue developing enhanced calcined petroleum coke solutions with tailored reactive properties. Forward-looking investments target sulfur capture technologies to expand application possibilities beyond traditional markets. With calcined petroleum coke serving as a crucial bridge between hydrocarbon processing and advanced materials manufacturing, its role in sustainable industrial ecosystems continues to strengthen.

(calcined petroleum coke from a refinery)

FAQS on calcined petroleum coke from a refinery

Q: What is calcined petroleum coke from a refinery?

A: Calcined petroleum coke (CPC) from a refinery is a high-carbon material derived from raw refinery petroleum coke through heating to remove moisture and volatile compounds. It primarily serves as a critical ingredient in aluminum anode production and steel manufacturing industries. Refineries produce it as a value-added product to optimize resource utilization.

Q: How do petroleum coke refineries convert raw coke to calcined petroleum coke?

A: Petroleum coke refineries heat raw petroleum coke in rotary or vertical kilns at 1200–1400°C, driving off impurities and increasing carbon purity. This calcination process enhances electrical conductivity and density, making it suitable for industrial applications. Precise temperature control ensures consistent quality for end-users like metallurgical plants.

Q: What are the key applications of refinery-produced calcined petroleum coke?

A: Refinery-produced CPC is vital for creating anodes in aluminum smelting and as a carbon raiser in steel production. It’s also used in titanium dioxide pigment manufacturing and as fuel in cement kilns due to its high calorific value. Its low impurity profile ensures efficiency in these demanding processes.

Q: Who are the top calcined petroleum coke manufacturers worldwide?

A: Leading global calcined petroleum coke manufacturers include Oxbow Corporation (USA), Rain Carbon Inc. (Germany), and Sinopec Group (China). These companies operate integrated refinery-to-calcination facilities across North America, Asia, and Europe. Their scale enables reliable supply chains for international markets.

Q: Why do refineries prioritize calcined petroleum coke production?

A: Refineries produce CPC to monetize heavy residual oils by transforming them into high-margin industrial products. This diversifies revenue streams beyond fuels while meeting strict environmental standards for waste reduction. The growing aluminum industry’s demand also drives sustained investment in calcination capacities.

Pervious

Pervious

Next

Next