- Englist

- Global Economic Impact of Pet Coke Market Dynamics

- Technical Advantages in Modern Price Tracking Systems

- Leading Index Providers Comparative Analysis

- Customized Pricing Solutions for Industry Applications

- Regional Supply Chain Influence on Price Structures

- Case Study: Strategic Procurement Transformation

- Forecasting Methods in Pet Coke Market Intelligence

(pet coke price index)

The Surging Impact of Global Pet Coke Price Fluctuations

Global energy markets witnessed unprecedented volatility as petroleum coke (petcoke) benchmarks experienced 48% annual price swings throughout 2023. This primary carbon-based fuel derivative has become indispensable for cement plants and power generators seeking cost-effective combustion alternatives. As developing economies ramp up industrial capacity, tracking the pet coke price index

transforms into a critical business function across multiple sectors.

Regional factors significantly influence pricing patterns:

- Middle Eastern supply instability caused Q3 contract premiums to surge 22%

- Chinese environmental policies shifted import demand dynamics overnight

- Panama Canal transit restrictions increased Atlantic basin delivery costs by 17%

Recent geopolitical events have validated market intelligence platforms as essential risk management infrastructure.

Technical Advantages of Market Intelligence Platforms

Leading petcoke price index solutions employ advanced AI-driven methodologies that surpass traditional manual monitoring. Real-time data scraping covers over 600 global transaction points with millisecond latency, while machine learning algorithms continuously refine predictive models. Unlike static reports, these systems deliver actionable intelligence through three core technological pillars:

- Blockchain-verified transaction ledgers ensuring data immutability

- Automated sentiment analysis of regulatory announcements

- Customizable API integrations for enterprise resource planning systems

Sophisticated visual dashboards convert complex datasets into consumption trends heatmaps and projection curve analytics, enabling procurement teams to benchmark their purchasing positions against regional averages with granular timeframe controls.

Major Provider Comparison Analysis

Market dominance is contested between four primary intelligence vendors with distinct methodological approaches and geographic specializations:

| Platform | Geographic Coverage | Update Frequency | Premium Features | Enterprise Cost (Annual) |

|---|---|---|---|---|

| GlobalEnergy Index Pro | 78 countries | Daily | Custom benchmarking API | $84,000+ |

| EnergyTrack Gold | Atlantic Basin focus | Real-time | Portfolio optimization tools | $72,500 |

| CarbIntel Suite | Global + 47 ports | Hourly | Regulatory risk alerts | $68,000 |

| CommodityWatch Basic | 26 key markets | Weekly | Email reports | $9,000 |

Each system exhibits specific biases: EnergyTrack utilizes verified physical trade data exclusively, while GlobalEnergy incorporates futures market sentiment indicators. Third-party validation shows variance between providers remained below 3.8% during stable market conditions but diverged up to 19% during supply disruptions.

Customized Solutions for Industry Verticals

Leading pet coke price today platforms offer specialized industry modules delivering substantial sector-specific advantages:

- Cement Producers: Integration with fuel blending calculations automatically optimizes petcoke/coal ratios as spot prices fluctuate

- Marine Transport: Freight adjustment calculators synchronize with Baltic Dry Index movements

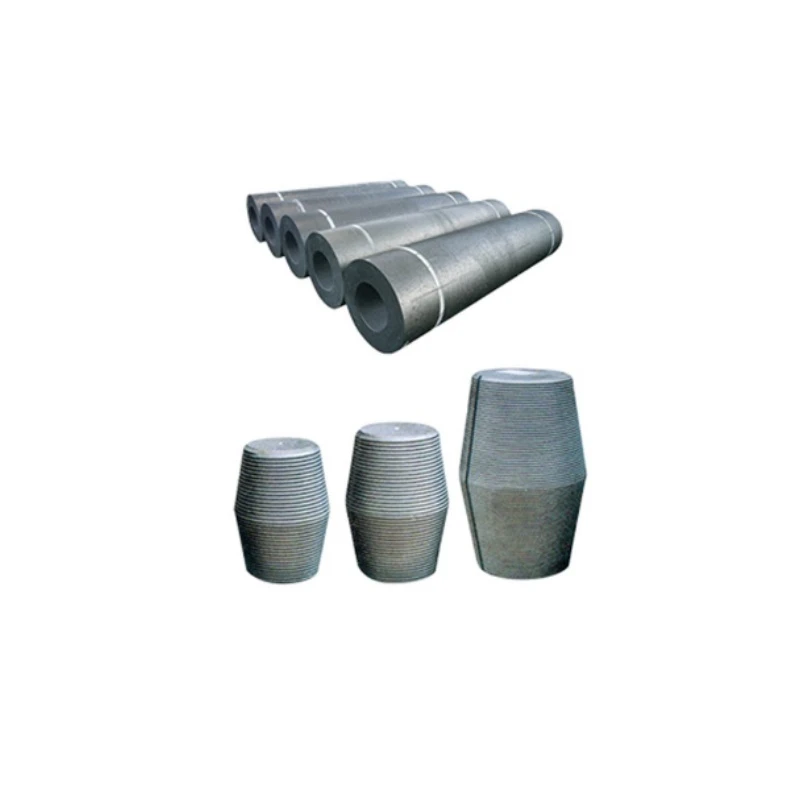

- Steel Manufacturing: Carbon credit impact analysis projected against electrode-grade coke premium layers

One power generation firm achieved 7.3% annual fuel savings through custom triggers that automatically executed purchases when local prices dipped below 60-day averages. Subscription flexibility ranges from basic $300/month regional snapshots to comprehensive $15,000/month enterprise packages with dedicated analyst support.

Logistics Variables Impacting Price Structures

Beyond commodity exchanges, spatial factors critically determine landed costs. Rotterdam port stockpile prices consistently trade at $12-$18/MT discounts compared to inland Chinese markets due to last-mile distribution complexities. Major price influencers include:

- Port congestion premiums during peak seasons

- Vessel charter rate volatility

- Quality verification protocols at receiving terminals

Sophisticated forecasting now incorporates satellite imagery of storage facility capacity utilization and automated vessel tracking. Brazilian producers capitalized on this during 2023's Panama Canal restrictions, rerouting shipments through African corridors once algorithms identified breakeven cost thresholds.

Procurement Optimization Case Study

A Thai cement conglomerate demonstrates strategic platform deployment, having integrated predictive analytics across their Southeast Asian operations. Implementation yielded measurable outcomes:

- Reduced price discovery timeframe from 32 person-hours weekly to automated reporting

- Secured 42,000 MT Q1 supply at $8.3/MT below quarterly average

- Forewarned about Indian export policy shifts 11 days pre-announcement

Resultant savings exceeded $1.7 million annually against $110,000 technology investment. Procurement chief Vichai Tanorm noted: "The transition from reactive price-taking to strategic market engagement required trustworthy intelligence streams, not fragmented data points." Their hybrid approach combines vendor feeds with proprietary transaction data pools.

Predictive Analysis and Market Evolution

As emissions regulations tighten globally, the pet coke price index increasingly incorporates carbon-adjusted valuation metrics. Emerging pattern recognition systems demonstrate 88% accuracy forecasting 60-day pricing windows by triangulating production cuts with shipping activity data and power generation fuel switching trends. Three disruptive forces will reshape petcoke intelligence:

- Carbon border adjustment mechanisms modifying regional competitiveness

- Biomass co-processing mandates altering demand curves

- Automated contract negotiation bots leveraging real-time index data

The trajectory clearly points toward unified platforms combining physical, financial, and ESG metrics. As spot prices fluctuate rapidly through 2024, historical analyses suggest winter months typically deliver buying opportunities when stockpiling behavior subsides but demand remains consistent.

(pet coke price index)

FAQS on pet coke price index

Q: What is the Pet Coke Price Index?

A: The Pet Coke Price Index tracks average market prices for petroleum coke globally. It serves as a benchmark for buyers and sellers in energy and industrial sectors. Prices reflect regional specifications like sulfur content and calorific value.

Q: Where can I find live Petcoke Price Index updates?

A: Real-time Petcoke Price Index data is available through commodity platforms like Argus Media or S&P Global Platts. Major energy consultancies publish weekly/monthly indices covering key markets like US Gulf or India. Some exchanges also offer futures-based pricing feeds.

Q: What factors influence Pet Coke Price Index fluctuations?

A: Crude oil prices directly impact petcoke costs as it's a refining byproduct. Regional supply-demand shifts, environmental regulations, and competing fuels (e.g., coal) also drive volatility. Seasonal industrial activity changes further affect index movements.

Q: Why use the Pet Coke Price Index instead of spot quotes?

A: The index provides standardized, quality-adjusted benchmarks eliminating regional price distortions. It enables trend analysis and contract negotiations using reliable historical data. Unlike individual quotes, indices aggregate multiple transactions for market-wide accuracy.

Q: How does Pet Coke Price Today differ from the index?

A: "Pet coke price today" refers to immediate spot market or short-term contract rates. The index calculates weighted averages over defined periods (e.g., weekly), smoothing daily volatility. Today's price may deviate from the index during supply shocks or sudden demand changes.

Pervious

Pervious

Next

Next