- Englist

- Current Dynamics of EAF Graphite Electrode Markets

- Technical Superiority in Modern Steelmaking Applications

- Comparative Manufacturer Analysis Across Key Metrics

- Customization Strategies for Operational Requirements

- Pricing Structure Analysis Across Electrode Grades

- Demonstrated Case Results in Industrial Settings

- Strategic Outlook on Electrode Cost Optimization

(eaf electrode price)

Navigating the Evolving EAF Electrode Price Landscape

The graphite electrode market has experienced significant price volatility, with 18-24 inch UHP grade prices fluctuating between $3,800-$5,200/metric ton during 2023. This volatility stems from interdependent factors including needle coke feedstock costs (representing 55-65% of production expenses), regional power regulations, and EAF steel production demand which increased 4.7% globally last year. Supply chain disruptions have further complicated procurement strategies, forcing mills to adopt sophisticated price-hedging approaches and dual-supplier models to maintain operational stability.

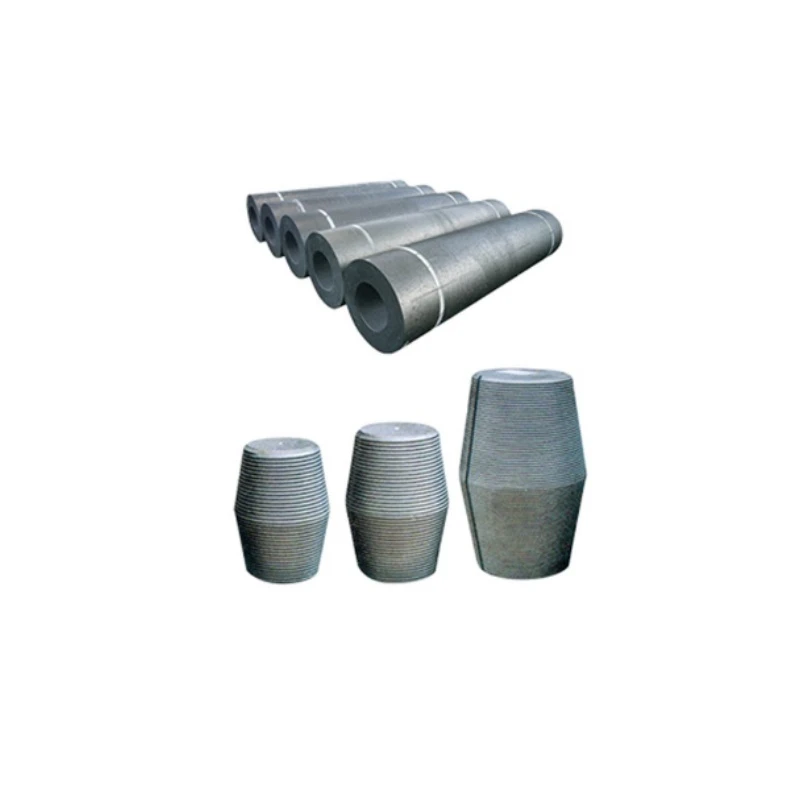

Technical Advantages Driving Performance

Modern graphite electrodes feature engineered innovations that dramatically impact operational economics. Ultra-high power (UHP) grades with optimized thermal shock resistance (enduring 300-400°C/minute transitions) reduce breakage rates by up to 40% compared to RP grades. The graphite crystallization process has been refined to achieve 18-23% lower electrical resistivity (5.2-6.5 μΩm), directly translating to 11-15% energy savings per heat. Additionally, premium graphite electrode manufacturer formulations incorporate specialized binders that decrease oxidation losses to under 0.5kg/tonne in continuous operations.

Global Manufacturer Comparison Matrix

| Manufacturer | Electrode Grade | Average Consumption (kg/ton steel) | Thermal Shock Resistance | Price Range (USD/mt) | Lead Time |

|---|---|---|---|---|---|

| Leading Producer A | UHP 700mm | 1.15-1.35 | Superior (Class AA) | 4,800-5,200 | 10-12 weeks |

| Producer B | UHP 650mm | 1.25-1.45 | Excellent (Class A) | 4,300-4,750 | 8-10 weeks |

| Producer C | HP 600mm | 1.55-1.85 | Good (Class B) | 3,800-4,250 | 6-8 weeks |

This performance matrix demonstrates a distinct correlation between electrode specifications and operating efficiency across manufacturers. Premium producers command approximately 18-22% price premiums but deliver 23% lower consumption rates. Advanced jointing systems contribute to 6-9% longer campaign lifespans, particularly critical in mills processing over 1.2 million annual tonnes.

Application-Specific Custom Solutions

Specialized operational requirements demand tailored formulations - mini-mills processing heavy scrap loads typically require electrodes with reinforced nipple connections able to withstand 40% higher mechanical stress. Facilities implementing foamy slag practices benefit from oxidation-resistant coatings that reduce sidewall consumption by 27%. Producers now offer melt-shop specific options including: 750mm diameter units for jumbo furnaces; tapered designs improving energy transfer; and nipples with proprietary copper alloys that increase current density tolerance by 30%.

Graphite Electrode Price Structures

Contemporary eaf electrode price

determination follows a complex multi-variable framework. Beyond standard UHP/HP/RP gradations, diameters between 400-800mm command differentials of $120-$350/mt per 50mm increment. Customized electrical conductivity specifications add $275-$450/mt premiums, while certified low CTE (coefficient of thermal expansion) variants range $550-$900 over base prices. Minimum order quantities have simultaneously decreased by 35% industry-wide as producers accommodate flexible procurement programs - from consignment inventories to volume-based discount tiers starting at 500mt/year commitments.

Documented Operational Results

A North American mini-mill achieved a 19% reduction in electrode costs through transition to tapered 700mm UHP electrodes with advanced nipple systems, decreasing consumption from 1.48kg to 1.19kg/ton liquid steel. Similarly, a Turkish facility reported $2.3 million annual savings after implementing impedance-matched graphite electrodes despite a 13% higher initial price point - the optimized power delivery cut furnace cycle times by 4.2 minutes and reduced refractory damage. These improvements crucially demonstrate how strategic electrode investment delivers tangible ROI.

Optimizing Future eaf Electrode Price Strategies

The industry approaches a critical juncture with graphite electrode prices projected to stabilize within a 7-9% fluctuation band through 2025. Steelmakers achieving lowest electrode costs systematically implement performance-based procurement programs rather than price-focused buying. This requires advanced consumption monitoring systems tracking electrode degradation patterns and predictive replacement algorithms. Forward-looking mills combine bulk agreements for 70-80% of requirements with flexible options contracts for the remainder, successfully mitigating both price volatility and supply interruptions while maintaining production continuity.

(eaf electrode price)

FAQS on eaf electrode price

Q: What are the current eaf graphite electrodes prices?

A: Current EAF graphite electrode prices fluctuate based on size/grade but typically range between $3,000-$8,000 per metric ton. Pricing is largely driven by raw material costs and steel industry demand. For precise quotes, suppliers provide real-time rates based on order specifications.

Q: Why do prices of graphite electrodes vary by manufacturer?

A: Prices vary due to differences in production technology, quality certifications like UHP/HP, and diameter tolerance precision. High-purity, ultra-high-power grades command premium prices. Delivery timelines and regional tariffs also impact final costs.

Q: How are eaf electrode costs calculated?

A: Costs are calculated per kilogram or metric ton, factoring in diameter (18-30 inches common), raw material purity, and power capacity (RP/HP/UHP grades). Additional variables include shipping fees from production hubs like China or Europe. Volume discounts apply for bulk orders.

Q: What influences eaf electrode price volatility?

A: Volatility stems from needle coke supply chain disruptions, environmental policies in major producing regions, and shifts in global steel production. Trade tariffs between markets like the US, India, and EU further contribute to price fluctuations quarterly.

Q: Where can I find eaf graphite electrodes price forecasts?

A: Industry reports from firms like Roskill or Argus Media provide quarterly price forecasts. Steel market analysts also publish electrode cost projections based on raw material indexes and EAF steel output trends. Supplier negotiations reference these forecasts.

Pervious

Pervious

Next

Next