- Englist

- Technical specifications and material advantages

- Comparative analysis of global manufacturers

- Customization capabilities and production flexibility

- Performance data across key industries

- Quality control and certification standards

- Pricing factors and market fluctuations

- Supply chain resilience and future developments

(graphite petroleum coke)

Understanding Graphite Petroleum Coke Characteristics

Graphite petroleum coke serves as a critical industrial material manufactured through delayed coking of heavy residual oils. This production process creates a high-purity carbon material containing 98-99.5% fixed carbon with sulfur levels maintained below 3%. Industrial-grade material exhibits excellent electrical conductivity (0.0025-0.005 ohm/cm) and thermal stability (up to 1300°C).

Material properties vary significantly between regular and needle grades:

- Density: 2.05-2.25 g/cm³ for electrode applications

- CTE (Coefficient of Thermal Expansion): 0.6-1.2 x10⁻⁶/°C

- Real Density: Minimum 2.13 g/cm³ for ultra-high power applications

- Porosity: Controlled at 18-32% for optimized reactivity

Premium producers utilize calcination processes reaching 1400°C to ensure optimal crystal structure development. Proper graphitization produces materials with X-ray diffraction patterns showing sharp 002 peaks, indicating well-ordered carbon layers critical for EAF performance.

Manufacturing Process Comparisons

Leading producers employ different technological approaches that impact material characteristics and operational costs:

| Process Feature | Rotary Kiln | Shaft Calciner | Multi-Hearth |

|---|---|---|---|

| Energy Consumption | 3.1-3.7 GJ/ton | 2.8-3.2 GJ/ton | 3.5-4.0 GJ/ton |

| Production Scale | 180-250 kt/yr | 400-600 kt/yr | 100-150 kt/yr |

| Sulfur Removal Efficiency | 85-88% | 92-95% | 78-82% |

| Impurity Control | Moderate | Precision | Variable |

| Investment Cost ($ million) | 120-160 | 350-420 | 80-100 |

Shaft calciners dominate premium market segments due to superior impurity separation, while rotary kilns remain preferred for commodity-grade output. Chinese producers installed 4.7 million tons of shaft capacity during 2018-2022, signaling quality-focused capacity expansion.

Custom Production Specifications

Industrial clients increasingly require bespoke graphite petroleum coke

formulations matching specific application requirements. Major manufacturers now offer seven standardized specifications alongside engineered solutions:

- Carbon Optimization: Fixed carbon content customized between 96.5% and 99.8%

- Particle Engineering : Pulverized (-200 mesh) to lump (10-50mm) configurations

- Elemental Control: Vanadium/nickel content reduced below 200ppm upon request

- Physical Treatments: Water quenching or delayed cooling for crystalline optimization

The material's bulk density can be engineered from 750 kg/m³ to 980 kg/m³ for specific smelting processes. Specialty facilities feature laboratory capabilities analyzing 35+ material attributes to confirm specifications before shipment. Turnaround for custom orders averages 8-12 weeks with MOQs ranging from 500 to 5,000 metric tons.

Industry Application Performance

Actual performance metrics vary significantly across different industrial implementations:

| Application Sector | Consumption (kg/ton output) | Power Savings | Typical Feed Specification |

|---|---|---|---|

| Ferroalloy Production | 480-520 | 140-160 kWh/ton | 97% C, S≤2.8% |

| Silicon Metal | 1,100-1,300 | 90-110 kWh/ton | 98.2% C, S≤2.0% |

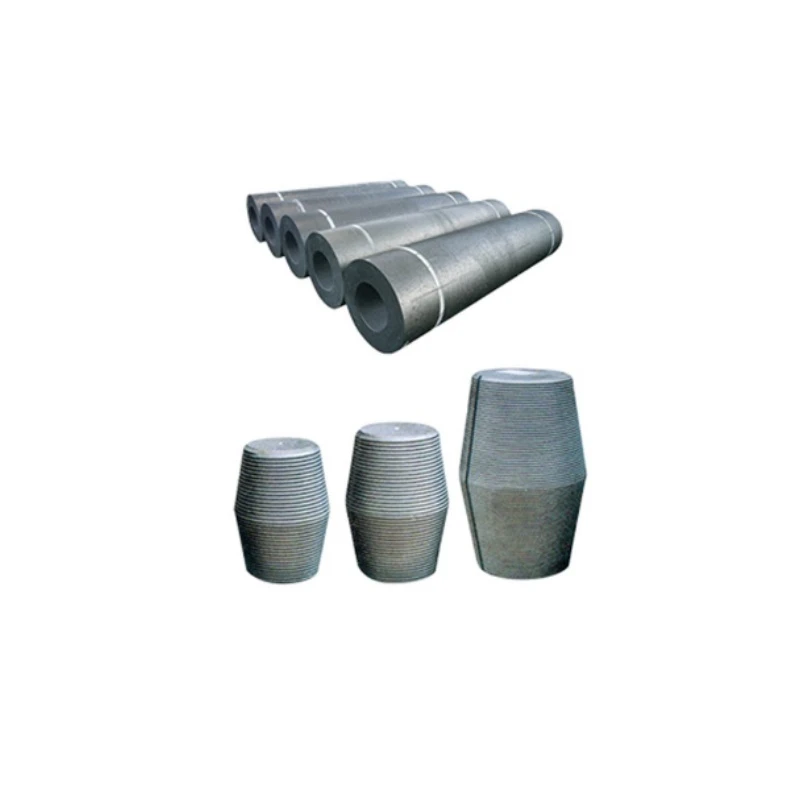

| Graphite Electrodes | 1.25-1.40 | N/A | 99%+ C, S≤1.5% |

| Titanium Dioxide | 280-330 | 15-18% process time reduction | 96.5% C, S≤3.0% |

In aluminum smelting, optimized graphite petroleum coke mixtures reduce anode consumption by 12-18% versus conventional materials. Pilot studies show 6-9% productivity increases when replacing conventional CPC with premium graphitized material in silicon production.

Quality Verification Standards

Material qualification requires multiple certification layers and verification protocols:

- ISO 80079-34: For explosive atmosphere applications

- ASTM D6374: Volatile matter analysis procedures

- ISO 18894: Coke reactivity index determination

- ISO 8006: Carbon materials for electrode manufacturing

Certified laboratories conduct minimum 11 quality checks per shipment, including Lc value measurements verifying crystal development between 25Å and 35Å. Major European manufacturers report < 1% quality variance across production batches, while Chinese facilities typically achieve < 3% tolerance through improved process controls. Global market surveillance indicates certified material commands 8-12% price premiums over uncertified alternatives.

Market Pricing Dynamics

The graphite petroleum coke price fluctuates based on four principal market factors:

- Raw Material Costs: Vacuum residue pricing variations impact production costs by 30-40%

- Logistics Constraints : Bulk vessel shipping rates increased 220-260% since 2020

- Production Adjustments : Planned maintenance shutdowns affect 15-18% of annual supply

- Trade Policy : Export duties ranging from 5% to 20% in key producing nations

Current spot market prices range between $420 and $980 per metric ton FOB, varying by specifications. Futures contracts indicate stabilizing premiums for low-sulfur grades (S<1.5%) compared to standard industrial material. Market intelligence suggests price volatility decreased from 35% monthly swings to 12-18% after implementation of quarterly contract pricing.

Ensuring Graphite Petroleum Coke Supply Security

Future capacity expansion focuses on sustainability enhancements without compromising core material properties:

- Carbon Capture: Pilot projects achieving 85% emission reduction during calcination

- Recycling Initiatives : 18% reduction in production waste through closed-loop systems

- Portfolio Diversification : Major consumers securing 3-5 year contracts with multiple suppliers

Leading graphite petroleum coke manufacturers currently invest $1.2-$1.8 billion annually in capacity improvements targeting 4.5% compound growth through 2030. New technologies like microwave graphitization could reduce processing energy requirements by 30-40%. Geopolitical strategies increasingly emphasize multi-regional sourcing with European buyers securing African supply contracts while US manufacturers develop South American partnerships.

(graphite petroleum coke)

FAQS on graphite petroleum coke

Q: What is graphite petroleum coke?

A: Graphite petroleum coke is a high-carbon material derived from refining crude oil. It undergoes calcination to remove volatile components, resulting in a solid carbon product. Primarily used in metallurgy and industrial applications, it offers excellent electrical conductivity and heat resistance.

Q: How to select a reliable graphite petroleum coke manufacturer?

A: Evaluate manufacturers based on production certifications (e.g., ISO), carbon content consistency (typically 98-99.5%), and shipment reliability. Review customer testimonials and request product samples to verify sulfur levels and ash content before bulk orders.

Q: What factors influence graphite petroleum coke price?

A: Pricing depends on carbon purity (higher grades cost more), global oil market fluctuations, and logistics expenses. Sulfur content below 0.5% or specialized particle sizes also command premium rates, with container shipping costs adding 10-20% to base prices.

Q: Why choose graphite petroleum coke over alternatives?

A: It provides superior electrical conductivity compared to anthracite coal and lower impurity levels than regular petroleum coke. Its optimized crystalline structure ensures efficient performance in lithium-ion battery anodes, aluminum smelting, and steel production.

Q: Can graphite petroleum coke be customized for specific industries?

A: Yes, manufacturers adjust particle size (1-5mm powders to 10-100mm lumps), sulfur content (0.2-0.8%), and calcination levels (1200-1500°C) to suit applications like titanium dioxide production, carbon raisers, or synthetic graphite electrodes.

Pervious

Pervious

Next

Next