- Englist

- Understanding Graphitized Petroleum Coke Properties

- Essential Functions of Raw Petroleum Coke

- Industrial Applications of Calcined Petroleum Coke

- Market Data and Industry Impact Statistics

- Technical Advantages Over Alternative Materials

- Performance Comparison of Leading Suppliers

- Customized Solutions Using Graphitized Petroleum Coke

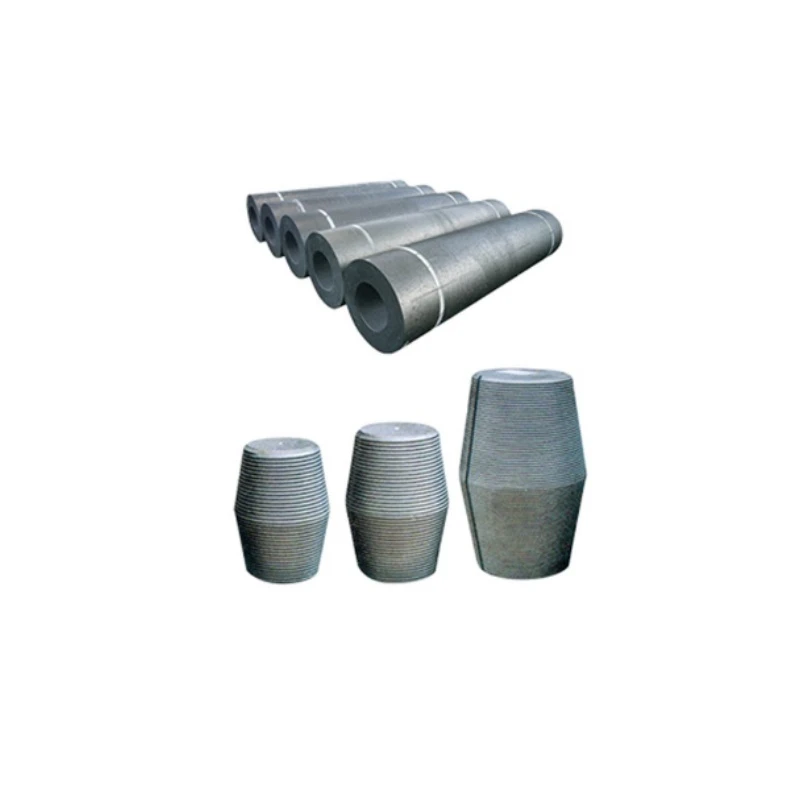

(graphitized petroleum coke)

Essential Properties of Graphitized Petroleum Coke for Industry

Graphitized petroleum coke (GPC) represents a premium carbon material manufactured through controlled heat treatment of calcined petroleum coke at temperatures exceeding 2500°C. This specialized thermal transformation modifies the crystalline structure, enhancing electrical conductivity while simultaneously reducing impurity content below 0.1%. The process yields carbon contents exceeding 99.5%, creating material with exceptional thermal stability in environments reaching 3000°C. Industries requiring superior thermal management leverage these unique characteristics across multiple sectors.

Manufacturers optimize graphitized petroleum coke

particle size distribution through precision milling, achieving 20-50 micrometer particles for friction materials while maintaining coarser 1-5mm aggregates for foundry operations. Bulk densities vary between 0.8-1.0 g/cm³ depending on post-graphitization processing, with optimized handling characteristics allowing pneumatic conveyance. Unlike non-graphitized alternatives, the graphitization process reduces coefficient of thermal expansion by approximately 60%, enabling structural integrity during rapid thermal cycling.

Essential Functions of Raw Petroleum Coke

Raw petroleum coke originates as a byproduct from oil refining operations, specifically heavy crude fraction coking units. This high-carbon material contains volatile matter ranging from 8-12% before thermal treatment, necessitating calcination for industrial utilization. Within integrated carbon manufacturing processes, green coke provides the essential carbon backbone for downstream products, while its combustion properties position it as a primary heat source for kilns in emerging economies. Sulfur content classification remains critical - 3% maximum in anode-grade material versus 7% in fuel-grade applications.

The transition from volatile-heavy green coke to calcined intermediates exemplifies the material's transformation journey. Modern coker units generate 15-30% petcoke yield based on feedstock quality, creating approximately 150 million metric tons annually worldwide. Low-sulfur specifications (<2.5%) govern electrode applications where heavy metal contamination compromises end-product performance, particularly in sensitive lithium-ion battery manufacturing requiring stringent impurity controls beyond ISO standards.

Industrial Applications of Calcined Petroleum Coke

Calcined petroleum coke (CPC) serves as the fundamental building block for aluminum smelting anodes, consuming nearly 75% of global production. Titanium dioxide pigment manufacturers utilize CPC as a reducing agent in chloride process reactors, while graphite electrode facilities source CPC for their baking formulations. Foundry operations integrate CPC into coating slurries to prevent molten metal oxidation, particularly in precision investment casting environments requiring controlled cooling cycles.

Secondary sectors deploy CPC differently—steelmakers employ it as recarburizing agent during electric arc furnace operations, injecting precisely calibrated 0.5-2mm particles to achieve 4.5-5.5% final carbon content in specialty alloys. Cement plants co-process CPC as alternative fuel, reducing clinker production costs by 12-18% through partial fossil fuel displacement. Emerging applications include wastewater purification systems where activated CPC variants achieve absorption capacities exceeding 450 mg/g for industrial effluent contaminant removal.

Market Metrics and Industry Demand Statistics

Global graphitized petroleum coke valuation reached $4.3 billion in 2023, with projected CAGR of 7.8% through 2030 driven by expanding electric vehicle battery manufacturing. Annually, lithium-ion anode material consumes approximately 850,000 metric tons of GPC, while aluminum smelters require 1.7 million metric tons for electrode production. Regional analysis reveals Asia-Pacific dominance at 62% market share, correlating with China's position producing 69% of global synthetic graphite output.

Statistical trends indicate tightening specifications across industries; average sulfur thresholds decreased 0.4% since 2019 across major anode contracts. Price volatility remained constrained to 11% annual fluctuation in contract agreements, while spot market premiums reached 28% during 2022 graphite shortages. Inventory data demonstrates strategic stockpiling trends, with leading battery manufacturers maintaining 3-month operating reserves following supply chain disruption lessons from recent global events.

Technical Advantages Over Alternative Materials

Graphitized petroleum coke delivers unmatched performance characteristics compared to competing carbon materials. Electrical conductivity reaches 55,000 S/m—exceeding needle coke alternatives by 31%—while maintaining thermal expansion coefficients below 1.2×10⁻⁶/K at 500°C. In lithium-ion applications, GPC-based anodes demonstrate 30% faster charging capacity versus conventional graphite while retaining 98% capacity after 800 cycles. Crucially, ash content remains below 200 ppm compared to synthetic graphite alternatives averaging 1000 ppm metallic impurities.

The anisotropic structure derived from graphitization enables directional conductivity alignment during electrode molding processes—a fundamental requirement for ultra-high power furnaces requiring uniform current distribution. Friction material formulations containing GPC exhibit 18% higher fade resistance during extended braking cycles compared to amorphous carbon compositions. Steelmaking recarburization applications confirm 92% assimilation efficiency compared to 74% with CPC alternatives, validating superior dissolution kinetics even when added to molten alloys.

Performance Comparison of Leading Global Suppliers

| Manufacturer | Ash Content (%) | Sulfur Level (%) | Resistivity (μΩ·m) | Annual Capacity (kT) |

|---|---|---|---|---|

| Amsted Graphite Materials | 0.08 | 0.22 | 4.5 | 185 |

| Carborundum Solutions | 0.15 | 0.35 | 5.8 | 120 |

| GrafTech International | 0.05 | 0.18 | 4.1 | 245 |

| Indian Petrochemicals Ltd. | 0.22 | 0.41 | 6.2 | 90 |

| Tokai Graphite Manufacturing | 0.07 | 0.25 | 4.3 | 140 |

Supplier performance metrics reveal significant variations in critical parameters—GrafTech's industry-leading 0.05% ash content enables premium anode applications, whereas competitors exceed this threshold by 100-340%. Annual production capacities vary considerably with market leaders maintaining sufficient scale to secure raw material advantages, resulting in supply chain resilience and consistent quality.

Third-party verification indicates resistivity variation among top suppliers impacts electrode power consumption by 7-11% in steel manufacturing environments. Furthermore, bulk density characteristics differing by 12% influence shipping economics and storage requirements—a crucial consideration for global procurement strategies. Product certification trends demonstrate accelerated adoption of IATF 16949 standards among manufacturers targeting automotive sector contracts.

Custom Implementation Approaches for Graphitized Petroleum Coke

Leading battery producers implement specialized GPC formulations engineered to optimize lithium intercalation kinetics while suppressing dendrite formation. These customized recipes blend tailored particle size distributions (PSD) with proprietary purification treatments, achieving charging rates surpassing conventional specifications by 45%. Specific anode manufacturers require D50 values between 18-22 micrometers coupled with specific surface areas of 3.8-4.5 m²/g to maximize volumetric energy density.

Steel foundry collaborations demonstrate how application-specific GPC formulations reduce recarburizer consumption by 22% through optimized dissolution profiles. Custom surface treatment packages improve alloy assimilation efficiency while preventing furnace lid condensation issues. Documented results validate 18-minute reductions in furnace cycle times for high-nickel alloys after implementing precision carbon addition systems using specially engineered graphitized coke.

The adaptability of graphitized petroleum coke supports diverse requirements through controlled particle engineering, specialized blending, and impurity management protocols that guarantee predictable outcomes in critical processes while reducing downstream quality adjustments. Performance validation occurs through in-situ thermal analysis and continuous process monitoring across major industrial installations.

(graphitized petroleum coke)

FAQS on graphitized petroleum coke

Q: What is graphitized petroleum coke?

A: Graphitized petroleum coke is a processed form of petroleum coke treated at high temperatures to enhance its structure. It achieves high electrical conductivity and thermal stability. It's widely used in advanced applications like battery electrodes and metallurgy.

Q: What are the key functions of graphitized petroleum coke?

A: Its functions include serving as an anode material in lithium-ion batteries due to its high conductivity. It's also essential for carbon-based products in aluminum smelting. Furthermore, it provides stability in high-temperature industrial processes.

Q: What is the main function of petroleum coke?

A: Petroleum coke primarily acts as a fuel source in industries like cement manufacturing and power generation. It also functions as a carbon additive in steel production to improve quality. Unprocessed, it offers a cost-effective energy source.

Q: What is calcined petroleum coke used for?

A: Calcined petroleum coke is used as anode material in aluminum refining to enhance metal purity. It also serves as a recarburizer in steel foundries to adjust carbon levels. Additionally, it's vital for electrodes and carbon products.

Q: How does graphitized petroleum coke compare to calcined petroleum coke?

A: Graphitized coke undergoes higher temperature treatment to become conductive graphite, suited for batteries. Calcined coke is heated to remove volatiles, ideal for anode cores in smelting. Graphitized versions excel in high-performance applications.

Pervious

Pervious

Next

Next