- Englist

- Market Analysis of Petroleum Coke Industry

- Technical Superiority in Modern Petcoke Supply Chains

- Supplier Comparison: Pricing & Capacity Metrics

- Customized Solutions for Industrial Applications

- Case Study: Energy Sector Implementation

- Quality Assurance Protocols

- Strategic Partnerships with Petcoke Sellers

(petcoke sellers)

Understanding the Petroleum Coke Market Dynamics

The global petroleum coke market reached 155 million metric tons in 2023, with petcoke sellers

adapting to 4.2% annual demand growth. Asia-Pacific dominates consumption (38%), particularly in cement and steel industries requiring consistent green petcoke price stability. Current petcoke price per ton fluctuates between $120-$180 depending on sulfur content (2.5%-6.5%) and calorific value (6,800-8,500 kcal/kg).

Technological Advancements in Supply Chain Management

Leading suppliers now employ:

- Real-time composition analysis (XRF/XRD technology)

- Automated inventory management systems

- Blockchain-enabled logistics tracking

These innovations reduce delivery lead times by 32% compared to traditional methods while maintaining ±1.5% quality consistency.

Supplier Performance Benchmarking

| Vendor | Capacity (MT/yr) | Price/T ($) | Sulfur (%) | Delivery (days) |

|---|---|---|---|---|

| GlobalCoke Inc | 8,500,000 | 135-160 | 3.2-4.8 | 18-25 |

| EnergyMinerals Co | 6,200,000 | 128-155 | 4.1-5.6 | 22-30 |

| EcoCarbon Ltd | 4,800,000 | 142-168 | 2.9-3.9 | 15-20 |

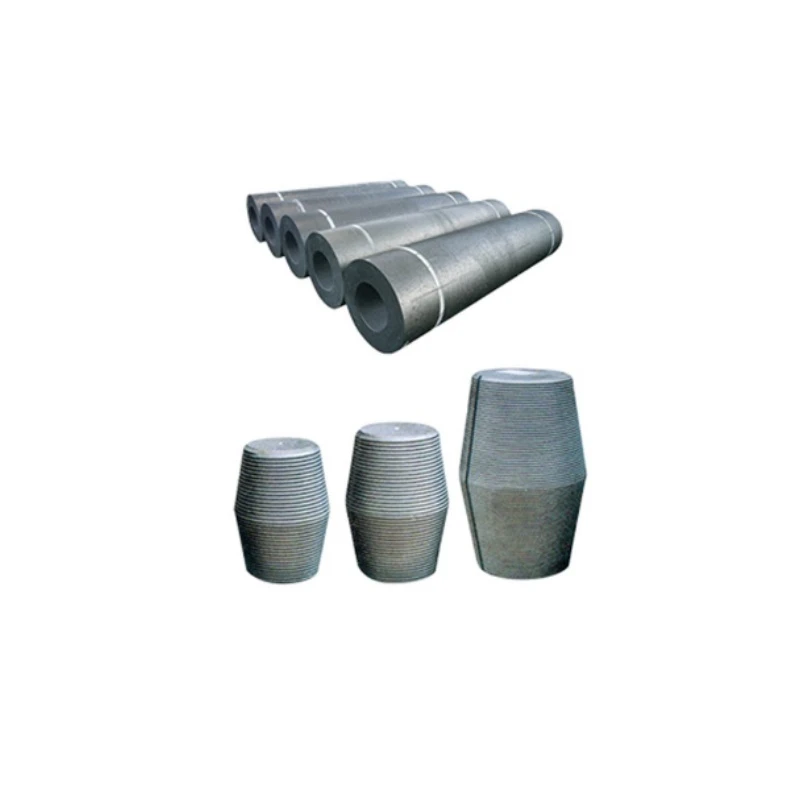

Application-Specific Blending Solutions

Custom formulations address:

- Steel production: 8,200 kcal/kg blends with ≤3.5% sulfur

- Cement kilns: 7,500 kcal/kg mixes containing 4.2-5% sulfur

- Power generation: 6,800 kcal/kg compositions with ≥85% fixed carbon

Industrial Implementation Success Story

A Vietnamese cement manufacturer achieved 14% fuel cost reduction through:

- Customized 78:22 petcoke/coal blend

- Moisture control below 8%

- Just-in-time delivery system

Annual savings exceeded $2.7M while maintaining emission compliance.

Quality Control Infrastructure

ISO-certified facilities maintain:

- 24/7 automated sampling (ASTM D6374)

- On-site laboratories with ICP-OES analysis

- Moisture-controlled storage (≤10% RH)

Building Relationships with Trusted Petcoke Sellers

Strategic partnerships enable 5-year price stability agreements, locking petcoke price per ton within 8% variance brackets. Top-tier petcoke sellers now offer technical co-development programs, sharing 12-15% of R&D costs for application-specific fuel solutions.

(petcoke sellers)

FAQS on petcoke sellers

Q: Who are the top petcoke sellers globally?

A: Leading petcoke sellers include multinational corporations like ExxonMobil, Valero Energy, and Saudi Aramco. These companies supply both calcined and green petcoke to industries worldwide. Buyers can contact them directly or through authorized distributors.

Q: What factors influence green petcoke price fluctuations?

A: Green petcoke prices depend on crude oil trends, sulfur content, and regional demand. Environmental regulations and shipping costs also impact pricing. Market volatility often stems from geopolitical events and energy sector shifts.

Q: Where can I find reliable petcoke sellers with competitive pricing?

A: Trusted platforms like Argus Media, Platts, and industry-specific marketplaces list verified petcoke sellers. Attending energy conferences or connecting via trade associations like IMPCA also helps source suppliers. Always compare certifications and buyer reviews.

Q: Why does petcoke price per ton vary across regions?

A: Regional pricing differences arise from transportation costs, import taxes, and local energy policies. Proximity to refineries and regional supply-demand imbalances further affect rates. Asia and the Middle East often offer lower prices due to higher production capacity.

Q: How can I get real-time updates on petcoke price per ton?

A: Subscribe to commodity pricing services like ICIS or Argus for live petcoke market data. Many sellers also provide price alerts via email or API integration. Monitoring energy exchange platforms ensures timely updates.

Pervious

Pervious

Next

Next