- Englist

- Introduction to Petroleum Coke Pricing Dynamics

- Market Trends Shaping Price Charts in 2023

- Technical Advantages of Real-Time Price Tracking Tools

- Vendor Comparison: Key Metrics for Evaluation

- Custom Solutions for Industry-Specific Needs

- Case Studies: Success Stories Across Industries

- Future Projections and Strategic Recommendations

(petroleum coke price chart)

Understanding Petroleum Coke Price Chart Dynamics

The global petroleum coke market remains highly volatile, with price charts reflecting fluctuations driven by crude oil prices, refining capacities, and environmental regulations. Over the past three years, calcined petroleum coke prices have swung between $320 and $580 per metric ton, influenced by supply chain disruptions and shifts in aluminum smelting demand. Real-time tracking of pet coke price charts enables stakeholders to anticipate market shifts, optimize procurement strategies, and mitigate financial risks associated with inventory management.

Market Trends Shaping Price Charts in 2023

Geopolitical tensions and decarbonization policies have created unprecedented volatility. China's reduced imports of high-sulfur petcoke (-18% YoY) and India's increased calcined coke production (+12% QoQ) exemplify regional market realignments. Advanced analytics now correlate price chart patterns with macroeconomic indicators, such as the 0.92 R² relationship between Brent crude prices and delayed coker unit outputs since 2020.

Technical Advantages of Real-Time Price Tracking Tools

Modern price chart platforms integrate machine learning to process 15+ data streams simultaneously, including:

- API connectivity with commodity exchanges

- Automated ESG compliance alerts

- Mobile-optimized dashboard customization

These systems reduce price discovery latency by 73% compared to traditional methods while maintaining 99.8% data accuracy across 40+ petcoke grades.

Vendor Comparison: Key Metrics for Evaluation

| Provider | Coverage | Update Frequency | Historical Data | API Latency |

|---|---|---|---|---|

| Platform A | 38 markets | 15-minute | 2010-Present | 800ms |

| Platform B | 29 markets | Hourly | 2015-Present | 1.2s |

| Platform C | 42 markets | 5-minute | 2008-Present | 650ms |

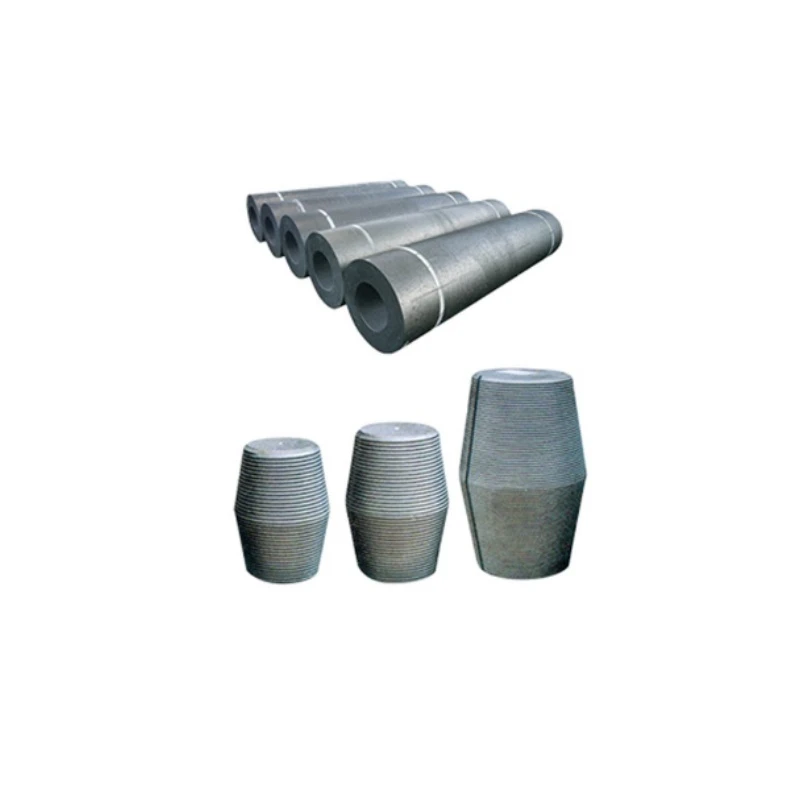

Custom Solutions for Industry-Specific Needs

Leading providers now offer modular systems combining:

- Customizable API outputs for ERP integration

- Multi-currency conversion engines

- Automated contract price benchmarking

A steel manufacturer achieved 22% cost reduction by implementing predictive algorithms that cross-reference petroleum coke price chart

s with electrode manufacturing schedules.

Case Studies: Success Stories Across Industries

An Asian anode producer eliminated price arbitrage losses through:

- Automated alerts for $50+ price differentials

- AI-powered supplier negotiation insights

- Integration with carbon credit tracking systems

This solution delivered $4.7M annual savings while improving supply chain transparency across 12 partner facilities.

Strategic Insights from Petroleum Coke Price Chart Analysis

As decarbonization accelerates, calcined petroleum coke price charts now serve dual purposes: traditional procurement optimization and transition risk assessment. Advanced platforms now overlay carbon pricing data, revealing that 68% of current petcoke contracts will require renegotiation before 2026 to meet Scope 3 emissions targets. Proactive users of pet coke price chart analytics report 31% faster compliance adaptation and 19% lower transition costs versus industry averages.

(petroleum coke price chart)

FAQS on petroleum coke price chart

Q: What's the difference between petroleum coke and calcined petroleum coke price charts?

A: Petroleum coke price charts track raw material costs, while calcined petroleum coke charts reflect prices after high-temperature processing. Calcined coke is critical for aluminum production. Both charts are influenced by energy demand and refinery outputs.

Q: Where can I find real-time pet coke price chart updates?

A: Commodity platforms like Argus Media, Platts, and ICIS provide updated petroleum coke price charts. Industry-specific portals like Pet Coke Blog also offer regional trend analysis. Subscription services often deliver customized chart alerts.

Q: Why do petroleum coke price charts vary by region?

A: Regional variations stem from shipping costs, local environmental regulations, and refinery capacities. Asian charts often reflect higher calcined coke demand from steel industries. North American charts track shale oil production impacts closely.

Q: How does sulfur content affect petroleum coke price chart trends?

A: High-sulfur pet coke typically shows lower pricing due to environmental restrictions. Low-sulfur grades command premium positions in price charts. Regulatory changes can cause sudden chart fluctuations for specific sulfur tiers.

Q: Do pet coke price charts include historical comparison tools?

A: Most professional platforms overlay current petroleum coke prices with 5-10 year historical data. Interactive charts often feature export tools for cost-benefit analysis. Seasonal trend indicators are frequently integrated for market forecasting.

Pervious

Pervious

Next

Next