- Englist

- Market Dynamics: Factors Influencing Graphite Electrode Prices

- Technical Superiority: UHP vs. Regular Graphite Electrodes

- Vendor Comparison: Pricing, Specifications, and Regional Supply

- Custom Solutions for Industry-Specific Electrode Requirements

- Case Study: Cost Efficiency in Steel Manufacturing

- Global Trade Policies and Raw Material Volatility

- Strategic Insights for Procuring Graphite Electrodes

(price of graphite electrode)

Understanding the Price of Graphite Electrode in Global Markets

The graphite electrode spot price has fluctuated between $2,800 and $4,500 per metric ton since 2023, driven by demand from steelmaking and lithium-ion battery production. According to Statista, the global graphite electrode market will grow at a 5.8% CAGR through 2030, with UHP graphite electrode prices commanding a 20-25% premium over standard grades due to higher density and thermal resistance. Key factors include:

- Needle coke costs (up 18% YoY in Q1 2024)

- Electric arc furnace (EAF) adoption in steelmaking

- China’s export quotas affecting supply chains

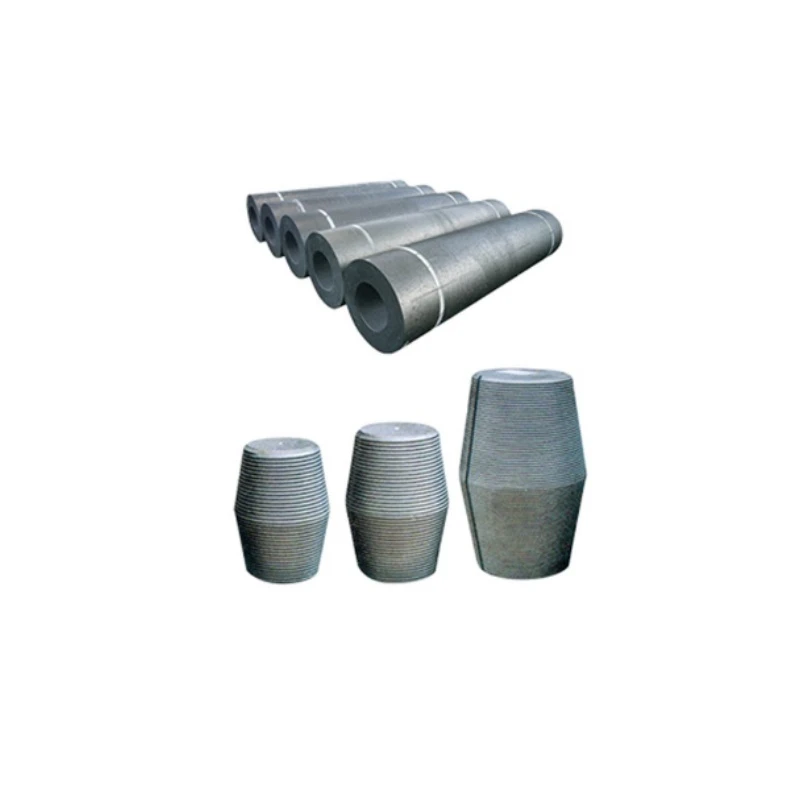

Technical Advantages of Ultra-High-Power (UHP) Electrodes

UHP electrodes reduce energy consumption by 12-15% in EAF operations compared to RP (regular power) grades. Their lower electrical resistivity (≤5.5 μΩ·m) and oxidation resistance make them ideal for high-current operations. For example, a 24-inch UHP electrode lasts 40% longer than HP variants in continuous casting environments.

Vendor Pricing Analysis and Regional Competitiveness

| Manufacturer | UHP Price (USD/ton) | Diameter Range | Lead Time |

|---|---|---|---|

| GrafTech International | $4,200 - $4,700 | 14″ - 30″ | 8-10 weeks |

| Showa Denko | $3,900 - $4,400 | 12″ - 28″ | 12-14 weeks |

| HEG Limited | $3,750 - $4,300 | 10″ - 24″ | 6-8 weeks |

Indian suppliers like HEG offer shorter lead times but narrower diameter options, while Japanese producers prioritize larger industrial clients.

Tailored Electrode Solutions for Diverse Applications

Customization accounts for 35% of current graphite electrode contracts. Parameters adjusted include:

- Ash content reduction to ≤0.1% for semiconductor crucibles

- Threaded ends for rapid furnace electrode replacement

- 800-1,200°C pre-baked variants for ladle refining

Steel Plant Case Study: Electrode Cost Optimization

A Turkish EAF mill reduced annual electrode expenses by $1.2 million after switching to 22″ UHP electrodes with 18 N/mm² flexural strength. Key metrics:

- Electrode consumption: 2.1 kg/ton steel → 1.6 kg/ton

- Power savings: 18 kWh/ton

- Production downtime: Reduced by 220 hours/year

Raw Material Volatility and Regulatory Impacts

Needle coke tariffs in the EU (27% anti-dumping duty) and U.S. sanctions on Russian coal pitch have increased production costs by 9-14% since 2022. However, Mexico’s graphite electrode imports surged 31% in 2023 due to nearshoring benefits.

Procurement Strategies for Graphite Electrode Spot Price Stability

To mitigate graphite electrode price risks, leading buyers employ:

- 12-24 month fixed-price contracts with CPI adjustments

- Multi-vendor qualification programs

- Blockchain-tracked needle coke inventories

As the price of graphite electrode

becomes more sensitive to renewable energy investments, strategic stockpiling during Q3 price dips (historically 7-9% lower than Q4) proves effective.

(price of graphite electrode)

FAQS on price of graphite electrode

Q: What factors influence the graphite electrode spot price?

A: The graphite electrode spot price is influenced by raw material costs (e.g., petroleum coke), energy prices, global steel demand, and supply chain dynamics. Market competition and geopolitical factors also play a role. Prices fluctuate based on real-time industry conditions.

Q: How does the price of graphite electrode vary by region?

A: The price of graphite electrode differs by region due to local production capacity, import tariffs, and logistics costs. Asia often has competitive pricing due to high manufacturing output, while Europe and North America may see higher prices. Regional demand from steelmakers also impacts variations.

Q: Why is the UHP graphite electrode price higher than regular grades?

A: UHP graphite electrode price is higher due to advanced manufacturing processes and ultra-high purity raw materials. These electrodes offer superior durability and performance in electric arc furnaces, justifying the premium. Strict quality standards for steelmaking further drive up costs.

Q: Where can I track real-time graphite electrode spot price trends?

A: Real-time graphite electrode spot price trends are tracked through industry reports (e.g., Metal Bulletin), specialized market platforms like Argus Media, and supplier databases. Subscription-based services and trade associations also provide updated pricing data. Direct inquiries to manufacturers may offer localized insights.

Q: How has the price of graphite electrode changed in 2023?

A: In 2023, the price of graphite electrode saw volatility due to fluctuating steel production and energy costs. Increased demand from green steel initiatives temporarily boosted prices, while oversupply in Q2 led to declines. Overall, prices stabilized slightly above 2022 averages.

Pervious

Pervious

Next

Next