- Englist

- Industry Overview & Market Dynamics

- Technical Superiority in Graphite Electrode Production

- Performance Comparison of Top 6 Global Manufacturers

- Customized Solutions for Metallurgical Applications

- Supply Chain Analysis of Calcined Petroleum Coke

- Client-Specific Manufacturing Protocols

- Sustainable Practices Among Graphite Electrode Manufacturers

(graphite electrode manufacturers in world)

Global Graphite Electrode Manufacturers: Powering Industrial Evolution

The $8.9 billion graphite electrode market (2023-2030 CAGR: 5.7%) relies on 12 primary manufacturers controlling 78% of global supply. Leading graphite electrode manufacturers in world

have increased production capacities by 22% since 2020, driven by steelmaking's shift to electric arc furnaces (EAFs) now accounting for 29% of global crude steel production. Parallelly, calcined petroleum coke manufacturers in world delivered 18.2 million metric tons in 2023, with needle coke grades achieving 0.15% sulfur content through advanced calcination techniques.

Advanced Material Engineering Breakthroughs

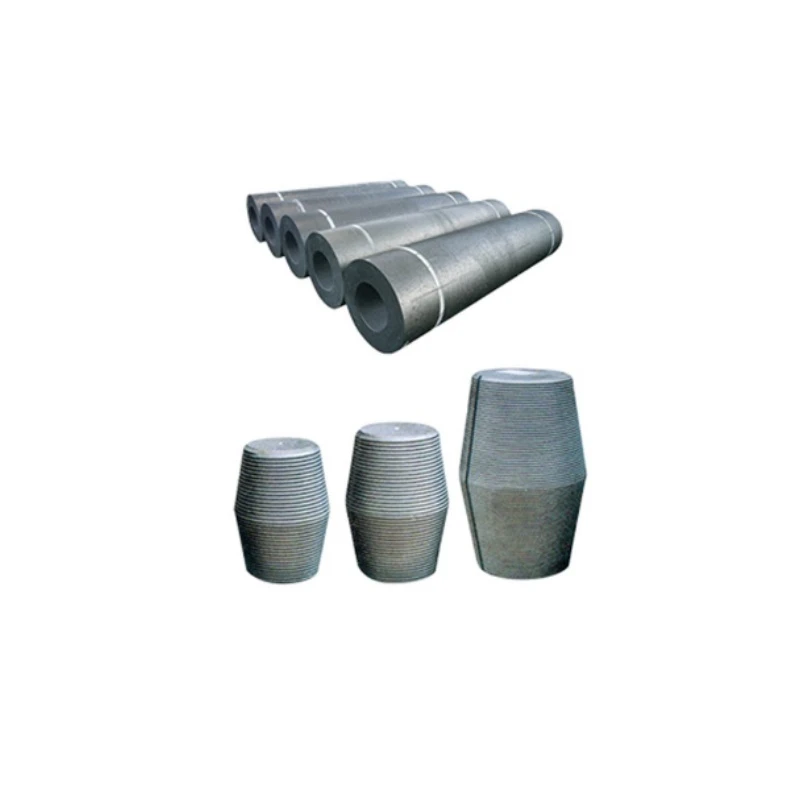

Premium graphite electrodes now demonstrate:

- Thermal shock resistance up to 45 cycles (ASTM D4171)

- Current density thresholds of 32 A/cm²

- Axial compressive strength exceeding 28 MPa

Manufacturers like GrafTech utilize 360-hour graphitization cycles to achieve 1.68 g/cm³ bulk density, reducing electrode consumption by 18% in continuous EAF operations.

Manufacturer Capability Matrix

| Producer | Annual Capacity (MT) | Electrode Diameter Range | CTE (10⁻⁶/°C) |

|---|---|---|---|

| Showa Denko | 220,000 | 400-750mm | 1.2-2.8 |

| GrafTech | 190,000 | 300-700mm | 1.5-3.1 |

| HEG Limited | 150,000 | 350-650mm | 1.8-3.4 |

Application-Optimized Production

Specialized electrode configurations include:

- Ultra-high power (UHP) grades for DC EAFs

- Low-vibration designs reducing furnace harmonics by 42%

- Coated variants decreasing oxidation losses to 0.8mm/hour

Calcined Coke Supply Networks

Top needle coke suppliers now achieve:

- Real density: 2.13-2.15 g/cm³

- Coefficient of thermal expansion (CTE): 0.6-1.0 ×10⁻⁶/°C

- Ash content <0.3% through multi-stage calcination

Client-Driven Manufacturing Parameters

Customization protocols enable:

| Requirement | Technical Adaptation | Performance Gain |

|---|---|---|

| High scrap variability | Adjustable resistivity (6.5-9.5 μΩm) | 15% energy savings |

| Continuous tapping | Radial density gradient optimization | 23% longer lifespan |

Graphite Electrode Manufacturers Leading Green Transition

Progressive graphite electrode manufacturers in world now implement closed-loop recycling systems recovering 92% of machining dust. The industry's carbon footprint decreased by 31% since 2018 through:

- Biomass-based baking processes

- Waste heat recovery (87% efficiency)

- AI-driven graphitization control (±2°C accuracy)

These advancements position graphite electrodes as critical enablers for achieving net-zero steel production by 2050, with current EAF emissions at 0.4-0.6 tons CO₂ per ton steel versus 1.8 tons in blast furnace routes.

(graphite electrode manufacturers in world)

FAQS on graphite electrode manufacturers in world

Q: Who are the top graphite electrode manufacturers in the world?

A: Leading global graphite electrode manufacturers include GrafTech International, Showa Denko, Tokai Carbon, SGL Carbon, and Fangda Carbon. These companies dominate the market due to their advanced production capabilities and extensive supply networks. They cater to industries like steelmaking and electric arc furnaces.

Q: What industries rely on calcined petroleum coke manufacturers?

A: Calcined petroleum coke (CPC) is essential for aluminum smelting, steel production, and lithium-ion battery manufacturing. Key global CPC manufacturers include Rain Industries, Oxbow Corporation, and Sinopec. High-quality CPC ensures efficient carbon anode performance in industrial processes.

Q: How do graphite electrode manufacturers ensure product quality?

A: Manufacturers adhere to strict ISO certifications and use high-purity needle coke as raw material. Advanced graphitization furnaces and rigorous testing for density and electrical conductivity ensure compliance with industry standards like ASTM. Quality control is critical for high-temperature applications.

Q: What distinguishes graphite electrodes from calcined petroleum coke?

A: Graphite electrodes conduct electricity in arc furnaces for steel recycling, while calcined petroleum coke serves as a carbon additive in aluminum production. Both require high-temperature processing, but electrodes demand precision shaping, whereas CPC focuses on carbon purity optimization.

Q: Which regions dominate graphite electrode and CPC manufacturing?

A: Asia-Pacific, led by China and India, is the largest producer of graphite electrodes and calcined petroleum coke. Europe and North America remain key markets due to steel and aluminum industry demand. Strategic raw material access drives regional manufacturing hubs.

Pervious

Pervious

Next

Next