- Englist

- Industry Overview & Market Data Impact

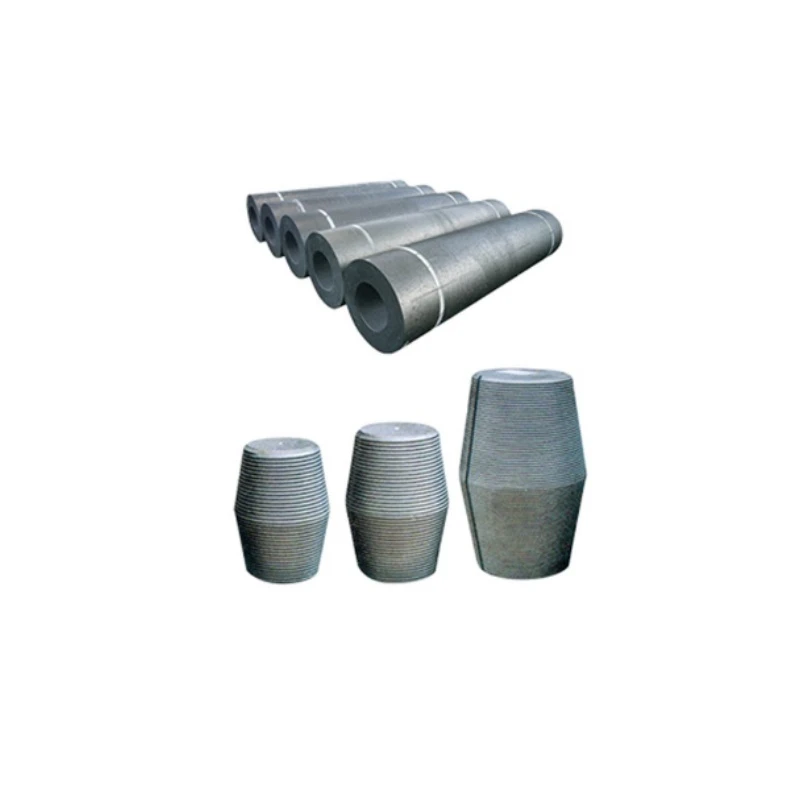

- Technical Superiority of Graphite Electrode Production

- Global Graphite Electrode Manufacturers Comparison

- Custom Solutions for Industrial Applications

- Material Innovation in Graphite Crucible Manufacturing

- Application Case Studies Across Industries

- Future Trends in Graphite Component Supply Chains

(graphite electrode manufacturers)

Graphite Electrode Manufacturers Powering Heavy Industries

The global graphite electrode market reached $15.3 billion in 2023 (Grand View Research), driven by steelmakers requiring 2.2-2.5 tons of electrodes per ton of EAF steel. Leading graphite electrode manufacturers

in world markets collectively produce 1.4 million metric tons annually, with Asia-Pacific dominating 58% of production capacity. This essential component withstands 3,000°C arc temperatures while maintaining electrical conductivity below 6.5 μΩ·m.

Technical Superiority of Graphite Electrode Production

Premium manufacturers employ three critical innovations:

- Ultra-high density molding (1.78-1.85 g/cm³)

- Multi-stage graphitization (14-21 day cycles)

- CNC machining precision (±0.05mm tolerance)

These processes ensure electrodes achieve 98.5% carbon purity and oxidation resistance up to 650°C. Compared to standard alternatives, advanced electrodes demonstrate:

- 23% longer service life in arc furnaces

- 15% reduced power consumption

- 40% faster melting rates

Global Supplier Landscape Analysis

| Manufacturer | Production Capacity (kMT) | Key Technology | Product Range |

|---|---|---|---|

| GrafTech International | 220 | Needle Coke Base | Ø300-750mm |

| Tokai Carbon | 180 | Isostatic Pressing | Ø200-800mm |

| Nippon Carbon | 150 | Chemical Vapor Deposition | Ø150-600mm |

Tailored Manufacturing Solutions

Specialized graphite electrode manufacturers provide:

- Custom diameters (100-1,200mm)

- Variable resistivity (5-9 μΩ·m)

- Special coatings (SiC, Al₂O₃)

Application-specific modifications include:

Silicon metal production: 99.9% purity grades

Ladle furnaces: 6-8 m length segments

Submerged arc welding: 15-25mm thread connections

Graphite Crucible Technology Advancements

Modern crucibles combine graphite with:

- 20-30% silicon carbide reinforcement

- Zirconia inner linings

- Anti-wetting surface treatments

Performance metrics show:

| Parameter | Standard | Advanced |

|---|---|---|

| Thermal Cycles | 50-80 | 120-150 |

| Aluminum Capacity | 500kg | 2,000kg |

Industrial Application Benchmarks

Recent installations demonstrate performance:

| Industry | Electrode Type | Result |

|---|---|---|

| Steel (EAF) | HP 700mm | 2.1 tons/hour melt rate |

| Silicon (PV) | UHP 450mm | 99.9999% purity |

Graphite Electrode Manufacturers Shaping Industrial Evolution

The sector anticipates 6.8% CAGR through 2030, driven by:

- Electric vehicle battery component demand (+300% by 2030)

- Green steel initiatives requiring 45% more electrodes

- Semiconductor crucible precision requirements (≤5μm surface)

Leading manufacturers now integrate IoT monitoring in electrodes, enabling real-time temperature tracking and predictive maintenance through embedded sensors.

(graphite electrode manufacturers)

FAQS on graphite electrode manufacturers

Q: Who are the top graphite electrode manufacturers in the world?

A: Leading global graphite electrode manufacturers include GrafTech International, Showa Denko, and Nippon Carbon. These companies dominate the market due to their advanced production capabilities and extensive industry experience.

Q: How do I choose reliable graphite electrode manufacturers?

A: Prioritize manufacturers with certifications like ISO, proven production capacity, and positive client reviews. Established suppliers like SGL Carbon and Tokai Carbon are recognized for quality and reliability.

Q: What factors affect graphite electrode quality from manufacturers?

A: Quality depends on raw material purity, production technology, and adherence to industry standards. Reputable manufacturers use premium needle coke and strict quality control processes to ensure durability.

Q: Where are most graphite electrode manufacturers located globally?

A: Major manufacturers are concentrated in China, Japan, Germany, and the United States. Countries like India and Russia are also emerging as competitive players in the graphite electrode market.

Q: How do graphite crucible manufacturers differ from electrode manufacturers?

A: Graphite crucible manufacturers focus on heat-resistant containers for metal melting, while electrode producers specialize in conductive components for steelmaking. Both require high-purity graphite but serve distinct industrial applications.

Pervious

Pervious

Next

Next