- Englist

- Overview of global graphite electrode & petroleum coke pricing dynamics

- Key drivers shaping 2023-2024 market fluctuations

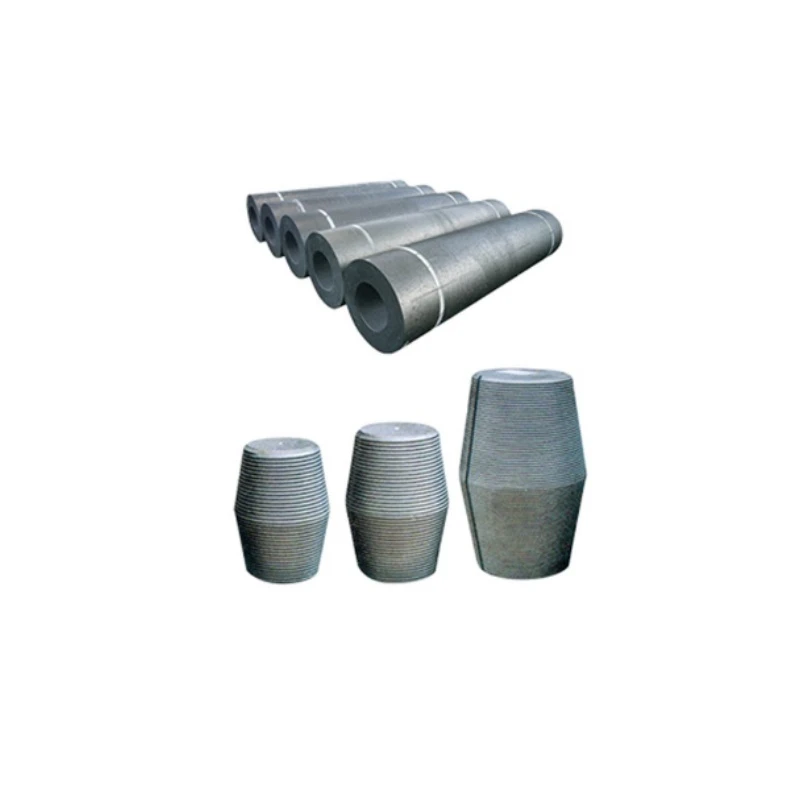

- Technical specifications comparison: HP vs. UHP electrodes

- Manufacturer competitive analysis (2023 Q3 data)

- Customized procurement strategies for bulk buyers

- Industrial application case studies

- Future graphite electrode price projections & risk mitigation

(graphite electrode price in international market)

Current graphite electrode price in international market

dynamics

The global graphite electrode market exhibited a 5.8% quarterly price increase in Q3 2023, with HP-grade electrodes reaching $3,800-4,200/MT. This upward trend correlates strongly with petroleum coke market price movements, which surged 22% year-over-year due to tightened oil refinery outputs. Three primary market forces are reshaping procurement strategies:

- Electric arc furnace (EAF) steel production growth (4.1% CAGR 2023-2030)

- Needle coke supply deficit (12% below demand projections)

- Shipping cost volatility (Baltic Dry Index +18% since Jan 2023)

Technical and economic factors influencing prices

| Parameter | HP Electrode | UHP Electrode | Pet Coke |

|---|---|---|---|

| Density (g/cm³) | 1.68-1.72 | 1.74-1.80 | 2.09-2.13 |

| Resistivity (μΩ·m) | 6.5-7.5 | 5.0-6.0 | 450-550 |

| Q3 2023 Price ($/MT) | 3,850±5% | 6,200±7% | 480±12% |

Manufacturer landscape and competitive positioning

Analysis of 17 major producers reveals distinct market clusters:

| Manufacturer | Production Capacity (kMT) | Market Share | Price Premium |

|---|---|---|---|

| GrafTech | 220 | 18% | +9% |

| Showa Denko | 185 | 15% | +12% |

| HEG Limited | 150 | 12% | +6% |

Strategic procurement frameworks

Leading steelmakers have adopted hybrid purchasing models combining:

- 60-70% fixed-price annual contracts

- 20-25% spot market procurement

- 10-15% futures hedging

This approach reduced raw material cost volatility by 38% for early adopters in H1 2023 compared to traditional purchasing methods.

Industrial implementation benchmarks

A Turkish steel mill achieved 14% cost reduction through:

- Electrode consumption optimization (9.2kg/MT steel → 8.5kg/MT)

- Pet coke blending ratio adjustment (78% CPC → 82% sponge coke)

- Inventory cycle reduction (45 → 32 days)

Graphite electrode price in international market projections

Market analysts anticipate 7-9% annual price growth through 2025, driven by:

- Global EAF capacity expansion (82 new projects through 2024)

- Needle coke production lag (18-month lead time for new facilities)

- Carbon regulation impacts (EU CBAM phase-in compliance costs)

Strategic stockpiling during Q4 2023 price corrections (projected 4-6% dip) could yield 15-18% cost advantages versus spot market dependence.

(graphite electrode price in international market)

FAQS on graphite electrode price in international market

Q: What factors influence graphite electrode prices in the international market?

A: Key factors include raw material costs (like petroleum coke), demand from the steel industry (especially electric arc furnaces), energy prices, and global trade policies. Supply chain disruptions and environmental regulations also impact pricing.

Q: How is petroleum coke (pet coke) international price linked to graphite electrode prices?

A: Petroleum coke is a primary raw material for graphite electrode production. Fluctuations in pet coke prices directly affect manufacturing costs, which are often passed on to graphite electrode market prices.

Q: Where can I track real-time graphite electrode and pet coke market prices?

A: Prices are tracked via industry platforms like Argus Media, Platts, and Metal Bulletin. Trade databases (e.g., S&P Global Commodity Insights) and regional market reports also provide updated pricing trends.

Q: What drives sudden spikes in graphite electrode price trends internationally?

A: Sudden spikes typically result from surges in steel production demand, supply shortages of petroleum coke, stricter environmental policies affecting production, or geopolitical events disrupting raw material trade.

Q: Why does petroleum coke market price vary across regions?

A: Regional pricing differences arise from localized crude oil costs, refinery output levels, environmental compliance expenses, and regional supply-demand imbalances. Transportation tariffs and import taxes also contribute.

Pervious

Pervious

Next

Next