- Englist

- Market Dynamics and Data Insights on Calcined Petcoke

- Technical Superiority in Production Processes

- Comparative Analysis of Leading Manufacturers

- Custom Solutions for Diverse Industrial Needs

- Case Study: Efficiency Gains in Aluminum Smelting

- Sustainability and Environmental Compliance

- Future Trends in Calcined Petroleum Coke Prices

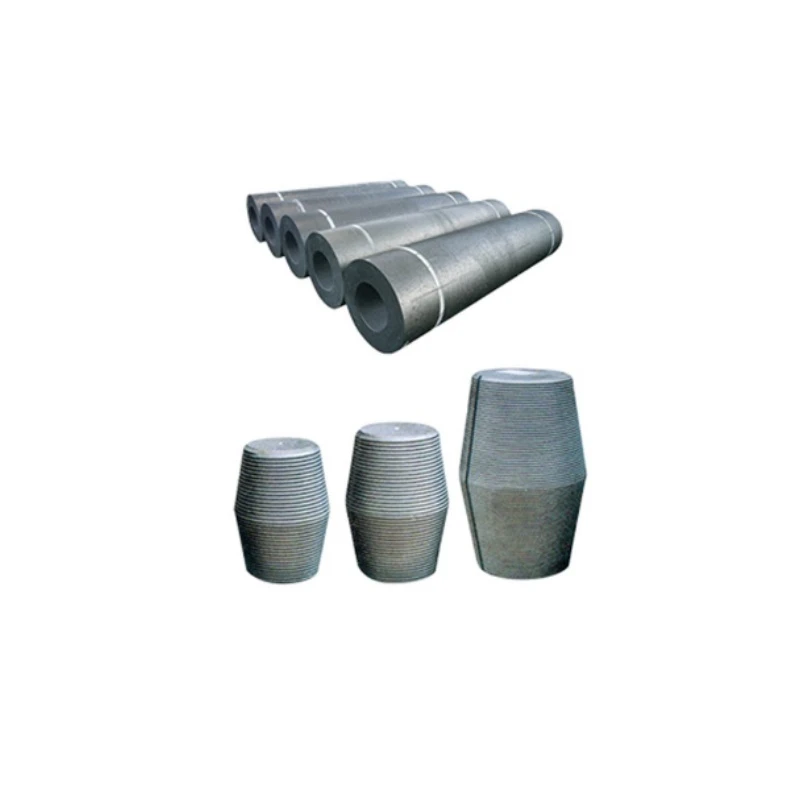

(calcined petcoke)

Market Dynamics and Data Insights on Calcined Petcoke

The global calcined petcoke

market is projected to grow at a CAGR of 5.2% from 2023 to 2030, driven by rising demand in aluminum and steel industries. Recent data indicates that calcined petroleum coke prices fluctuated between $380-$520 per metric ton in Q2 2024, influenced by crude oil volatility and carbon emission regulations. Key regions like Asia-Pacific account for 62% of consumption, with China and India leading production and imports.

Technical Superiority in Production Processes

Advanced calcination technologies, such as rotary kilns and vertical shaft calciners, enhance carbon purity (up to 99.5%) while reducing sulfur content below 2.5%. Proprietary graphitization methods improve electrical conductivity, making high-grade calcined petcoke indispensable for lithium-ion battery anodes. Emission control systems, including scrubbers and electrostatic precipitators, ensure compliance with ISO 14001 standards.

Comparative Analysis of Leading Manufacturers

| Manufacturer | Sulfur Content (%) | Carbon Content (%) | Moisture (%) | Price Range ($/MT) |

|---|---|---|---|---|

| Rain Industries | 2.1-2.8 | 98.7 | 0.3 | 410-490 |

| Oxbow | 1.9-2.4 | 99.2 | 0.2 | 450-520 |

| Minerais | 2.3-3.0 | 98.5 | 0.4 | 380-460 |

Custom Solutions for Diverse Industrial Needs

Tailored calcined petcoke blends address specific client requirements:

- Anode-Grade: 99% fixed carbon, ≤2% sulfur for aluminum smelters

- Fuel-Grade: 97% fixed carbon, ≤4% sulfur for cement kilns

- Specialty-Grade: Ultra-low metals (V+Ni < 300ppm) for titanium dioxide production

Case Study: Efficiency Gains in Aluminum Smelting

A Middle Eastern smelter achieved 12% lower energy consumption and 8% higher anode life by switching to premium calcined petcoke with 99.1% carbon purity. Over 18 months, this translated to:

- Annual savings: $2.4M in power costs

- Production increase: 15,000 MT/year

- CO₂ reduction: 28,000 MT/year

Sustainability and Environmental Compliance

Modern calcination plants now recycle 92-95% of waste heat, slashing natural gas usage by 35%. Emission rates for particulate matter have been reduced to <15 mg/Nm³, exceeding EU BAT criteria. Carbon credit programs offset 18-22% of operational costs for compliant producers.

Future Trends in Calcined Petroleum Coke Prices

Analysts predict calcined petcoke prices will stabilize at $430-$480/MT by Q1 2025 as green production capacity expands. Innovations in microwave calcination could cut processing costs by 20%, while ESG-focused investors are prioritizing suppliers with verified Scope 3 emission reductions. The shift toward circular economy models ensures calcined petcoke remains central to low-carbon industrial strategies.

(calcined petcoke)

FAQS on calcined petcoke

Q: What factors influence calcined petcoke prices?

A: Calcined petcoke prices are influenced by crude oil costs, supply-demand dynamics, and regional market conditions. Environmental regulations and aluminum/steel industry demand also play key roles. Global trade policies and transportation expenses further impact pricing.

Q: How is calcined petcoke produced?

A: Calcined petcoke is made by heating raw petroleum coke to 1200–1350°C to remove moisture and volatile matter. This process enhances carbon content and electrical conductivity. The product is primarily used in aluminum smelting and steel manufacturing.

Q: Why do calcined petroleum coke prices vary by region?

A: Regional price differences stem from logistics costs, import/export tariffs, and local supply availability. Energy policies and environmental compliance standards also contribute. Demand fluctuations in industries like cement or titanium dioxide further drive disparities.

Q: How can I track calcined petcoke price trends?

A: Monitor industry reports from agencies like Argus Media or ICIS for real-time data. Subscribe to market newsletters or aluminum/steel sector updates. Analyze crude oil trends and global manufacturing indices for predictive insights.

Q: What are the main applications of calcined petcoke?

A: Calcined petcoke is vital as an anode material in aluminum production and a carbon additive in steelmaking. It’s also used in titanium dioxide pigment manufacturing and cement kilns. Its high carbon purity makes it ideal for reducing metal oxides.

Pervious

Pervious

Next

Next