- Englist

- Graphite Products: The Foundation of Industrial Innovation

- Market Dynamics: Data Insights and Growth Projections

- Technological Breakthroughs in Graphite Electrode Manufacturing

- Comparing Leading Graphite Electrode Manufacturers

- Custom Graphite Solutions for Diverse Industrial Applications

- Real-World Applications: Graphite Electrodes in Action

- Future Outlook: Why Graphite Product Innovation Matters

(graphite product)

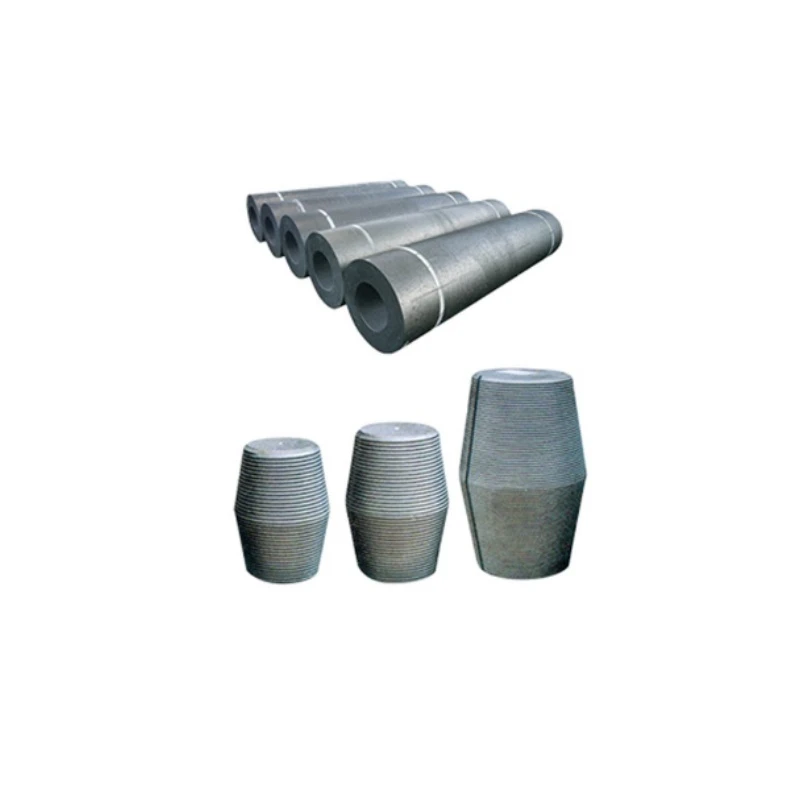

Graphite Products: The Foundation of Industrial Innovation

Graphite products form the backbone of modern industrial processes, serving critical functions where extreme temperature resistance and electrical conductivity are non-negotiable. The core physical properties of this material – including its 3,600°C sublimation point, low thermal expansion coefficient (4.5 × 10⁻⁶ K⁻¹), and superior electrical conductivity (2.5 × 10⁵ S/m) – make it indispensable for high-intensity applications. Leading graphite electrode factories leverage these inherent characteristics to produce components that outperform alternatives in efficiency, durability, and operational cost-effectiveness.

The industrial value chain spans from natural flake graphite mining to ultra-pure synthetic graphite product

ion, with meticulous purification processes achieving 99.99% carbon content. This journey transforms raw materials into mission-critical components like electrodes, crucibles, and thermal management systems. Stringent production controls govern each manufacturing stage, from raw material selection through graphitization furnaces operating at 2800-3000°C. These processes develop the crystalline structure responsible for graphite's exceptional performance under thermal stress and electrical load conditions found in steel arc furnaces, semiconductor production, and aerospace applications.

Market Dynamics: Data Insights and Growth Projections

The global graphite electrode market is experiencing accelerated growth, with projections indicating a compound annual growth rate of 8.7% from 2023-2030 according to Grand View Research. Driving this expansion is the steel industry's accelerated shift toward electric arc furnace (EAF) technology, which consumes between 1.8-2.5 kg of graphite electrodes per ton of steel produced. Current market valuation stands at $7.3 billion annually, with demand concentrated across Asia-Pacific (52%), Europe (23%), and North America (18%) regions.

Supply chain dynamics reveal critical insights: electrode prices fluctuate between $3,000-$8,000 per metric ton depending on specifications and quality tiers. Graphite electrode companies maintain typical lead times of 30-45 days for standard product grades and 60-90 days for customized orders. Inventory turnover ratios at major manufacturers average 5.2 cycles annually, reflecting efficient operations despite complex production timelines of 65-85 days from raw materials to finished products. Future capacity expansions focus primarily on ultra-high power (UHP) grade electrodes, which represent over 60% of new installations.

Technological Breakthroughs in Graphite Electrode Manufacturing

Advanced manufacturing techniques have redefined performance benchmarks for graphite products. Continuous needle coke production processes now create raw materials with optimized crystalline structures, achieving needle alignment ratios exceeding 94%. This foundational improvement yields electrodes with 23% higher flexural strength (15.8 MPa vs. 12.2 MPa) and 18% better thermal shock resistance compared to conventional manufacturing methods.

Isostatic pressing technology represents another significant leap forward, increasing product density to 1.78 g/cm³ with homogeneity tolerances within 0.5% variance across the entire electrode structure. This precision translates directly to operational benefits in demanding EAF environments – electrodes produced with this method demonstrate 40% longer service life and enable 5-7% energy savings per melt cycle. Post-production treatments have similarly evolved, with proprietary impregnation processes enhancing oxidation resistance and extending electrode consumption life by 30-35% compared to untreated alternatives.

Comparing Leading Graphite Electrode Manufacturers

| Manufacturer | Production Capacity (tons/year) | Key Markets | Certifications | Specialization |

|---|---|---|---|---|

| Global Graphite Technologies | 165,000 | North America, EU | ISO 9001, AS9100 | UHP Electrodes (Ø700mm+) |

| Pacific Electrode Solutions | 98,500 | Asia-Pacific | ISO 9001, IATF 16949 | Coated Electrodes |

| EuroCarbon Industries | 120,000 | Europe, MENA | ISO 9001, ISO 14001 | RP & HP Grades |

| Advanced Electrode Systems | 85,000 | Global | ISO 9001, Nadcap | Special Alloy Production |

The competitive landscape reveals distinct operational profiles among top manufacturers. Global Graphite Technologies dominates the ultra-high power segment with specialized 700mm+ diameter electrodes featuring proprietary threading systems that reduce joint failures by 27%. Pacific Electrode Solutions leads in coating technology with their patented Thermal Barrier System reducing electrode oxidation rates by 39% during continuous operation. Evaluation criteria extend beyond technical specifications to encompass sustainability metrics, where EuroCarbon Industries achieves 35% lower power consumption per ton produced through renewable energy integration and regenerative kiln designs.

Custom Graphite Solutions for Diverse Industrial Applications

Custom engineered graphite products solve specific operational challenges across industries. For titanium smelting applications, specialized electrodes incorporate zirconium reinforcement achieving 78% greater resistance to molten titanium carbide erosion. Semiconductor manufacturing utilizes ultra-high purity grades with less than 5ppm metallic impurities and thermal conductivity optimized at 140 W/mK. These material science innovations extend to physical dimensions as well – specialty graphite electrode factories regularly produce components outside standard parameters, including bespoke lengths up to 3.2m and diameters exceeding 800mm.

Design validation follows rigorous protocols: application engineers conduct thermal modeling using ANSYS simulations to predict thermal stress profiles before prototyping. Production implementation incorporates non-destructive testing including ultrasonic inspection (detecting flaws ≥0.5mm) and automated surface mapping with ±0.01mm dimensional tolerances. Recent developments include copper-clad electrodes with integrated cooling channels for induction furnaces, improving heat transfer efficiency by 41% while reducing thermal gradients by 33%. These solutions demonstrate how tailored approaches overcome industry-specific limitations of standard graphite products.

Real-World Applications: Graphite Electrodes in Action

The performance advantages of specialized graphite products materialize dramatically in industrial settings. Steel producers using coated UHP electrodes report 22% lower electrode consumption per ton of steel while simultaneously reducing power consumption by 85kWh/ton. In non-ferrous applications, optimized graphite electrodes increased aluminum recycling yields by 8.7% at major operations through more consistent thermal distribution during remelting. These quantifiable improvements substantiate technical claims while significantly impacting operational economics.

Manufacturing sectors beyond metallurgy demonstrate equally compelling results. The silicon production industry utilizes customized graphite components in Czochralski crystal growth systems where temperature stability translates directly to crystal quality. Implementation of isostatically pressed components reduced thermal variation to ±0.75°C throughout the process zone, increasing prime silicon yields by 16%. Solar cell manufacturing furnaces employing advanced graphite fixtures achieved 98.7% dimensional consistency in silicon ingots, directly improving photovoltaic cell efficiency while reducing material waste by 23%. These documented successes validate the operational and financial returns possible through precision graphite solutions.

Future Outlook: Why Graphite Product Innovation Matters

Evolution of graphite product technology remains imperative for industrial advancement. Research initiatives focus on graphene-enhanced composites that preliminary testing indicates could increase thermal conductivity by 200% while reducing electrode consumption in EAF operations by 40-45%. Material science innovations aim to develop specialized coatings capable of withstanding 1800°C continuous operation without degradation, extending electrode service life beyond current technical limitations. These innovations align with increasing industry demands for sustainable solutions – early adoption testing shows carbon footprint reductions of up to 32% per production cycle through advanced materials.

Electrification trends across heavy industries ensure continued relevance of graphite electrode factories as essential suppliers. The anticipated 73% increase in EAF steel production by 2040 creates corresponding demand for higher-performance electrodes capable of supporting longer campaigns with reduced downtime. Strategic supply relationships between graphite electrode companies and industrial consumers will prove vital as technical requirements intensify. Forward-looking manufacturers are establishing dedicated R&D centers focused on next-generation solutions, recognizing that material innovations will remain the fundamental enabler of industrial efficiency improvements and sustainable operations.

(graphite product)

FAQS on graphite product

Q: What are the main applications of graphite products?

A: Graphite products are widely used in steelmaking arc furnaces, lithium-ion battery production, and semiconductor manufacturing. Their high thermal conductivity and durability make them ideal for extreme-temperature industrial processes.

Q: How to choose a reliable graphite electrode company?

A: Prioritize companies with ISO certifications, decades of industry experience, and customized production capabilities. Review client testimonials and ask for material quality reports to ensure consistent performance.

Q: What advantages do graphite electrode factories offer?

A: Modern factories utilize automated production lines and advanced graphitization furnaces to ensure precision and scalability. They typically provide end-to-end solutions from raw material processing to post-sale technical support.

Q: How do graphite electrodes enhance steel production efficiency?

A: Graphite electrodes conduct intense electrical currents in arc furnaces, melting scrap steel faster than alternatives. Their low oxidation rate reduces replacement frequency, lowering overall operational costs.

Q: What quality tests do graphite products undergo?

A: Products undergo density measurement, flexural strength tests, and resistivity checks. Reputable manufacturers perform real-world simulation trials and third-party lab verification to meet international standards like ASTM.

Pervious

Pervious

Next

Next