- Englist

- Overview of Raw Pet Coke and Its Industrial Significance

- Technical Advantages Over Alternative Materials

- Supplier Comparison: Key Metrics and Market Leaders

- Customized Solutions for Diverse Applications

- Case Studies: Efficiency Gains in Real-World Scenarios

- Pricing Trends and Market Volatility Analysis

- Sustainable Practices in Raw Petroleum Coke Utilization

(raw pet coke)

Understanding Raw Pet Coke and Global Industrial Demand

Raw petroleum coke (RPC), a carbon-rich byproduct of oil refining, serves as a critical feedstock for aluminum smelting, steel production, and power generation. Global consumption reached 142 million metric tons in 2023, driven by developing economies' infrastructure expansion. Unlike calcined variants, raw pet coke

maintains inherent volatile matter (8-12%) that enhances combustion efficiency in specific industrial processes.

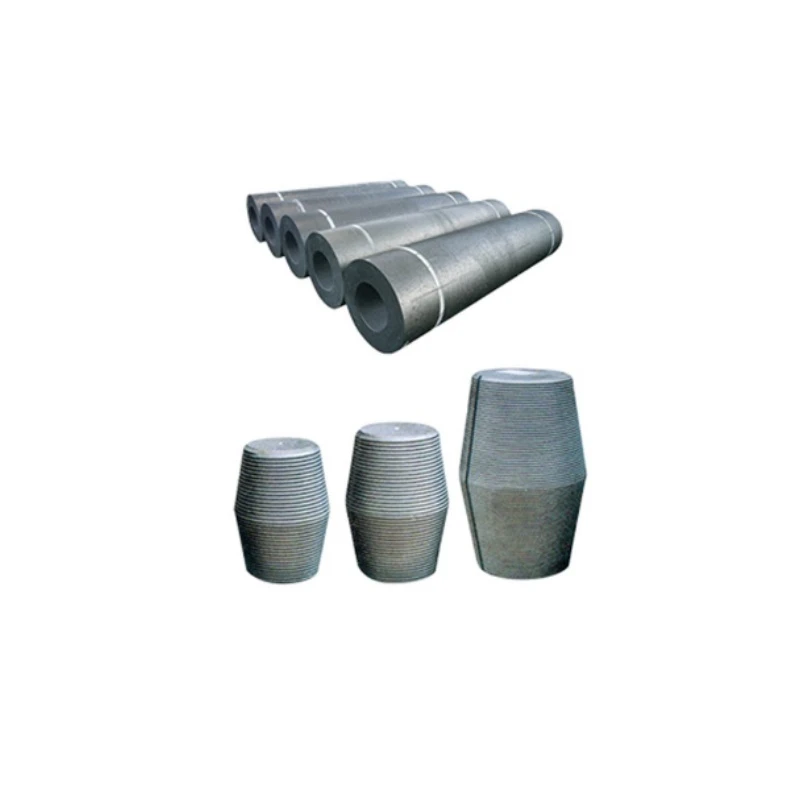

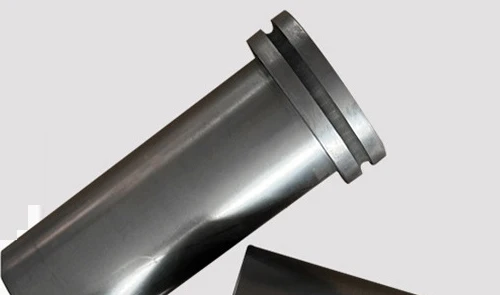

Technical Superiority in Heavy Industries

Modern refineries employ delayed coking technology to optimize raw petroleum coke quality, achieving consistent sulfur content below 4.5% and metallic impurities under 300 ppm. Comparative analysis reveals:

| Parameter | Raw Pet Coke | Coal | Biomass |

|---|---|---|---|

| Carbon Content | 85-92% | 60-75% | 45-50% |

| Ash Residue | 0.5-3% | 8-15% | 4-8% |

| Energy Density (MJ/kg) | 32.5 | 24 | 17 |

Supplier Landscape and Quality Variance

North American suppliers dominate 58% of global raw petroleum coke exports, with Middle Eastern producers gaining market share through competitive pricing. Key differentiators include:

| Producer | Sulfur (%) | Moisture | Price/Ton (USD) |

|---|---|---|---|

| US Refiner A | 3.2 | 8% | 85 |

| Middle East Refiner B | 4.1 | 6% | 78 |

| Asian Refiner C | 4.8 | 10% | 72 |

Application-Specific Material Engineering

Leading suppliers now offer granulometry customization (1-100mm particles) and moisture stabilization packages. For cement manufacturers, blended raw pet coke formulations reduce NOx emissions by 18-22% compared to traditional fuel mixes. Power plants utilizing fluidized-bed combustion report 94% material utilization rates with pre-treated feedstock.

Operational Efficiency Case Evidence

A Brazilian aluminum smelter achieved 14% energy cost reduction through optimized raw petroleum coke blending ratios. Operational data from Q2 2023 shows:

| Metric | Before | After |

|---|---|---|

| Anode Consumption | 420kg/t Al | 387kg/t Al |

| Flue Gas Temp | 280°C | 245°C |

| Production Yield | 91.2% | 93.8% |

Market Dynamics and Procurement Strategy

The raw petroleum coke price fluctuated between $68-$112/ton in 2023, correlating strongly with Brent crude volatility (R²=0.87). Strategic stockpiling during Q1 price dips enabled early adopters to secure 19-23% cost advantages over competitors. Forward contracts now cover 65% of industrial buyers' annual requirements, up from 42% in 2020.

Raw Pet Coke in Circular Industrial Ecosystems

Advanced capture systems now recycle 92% of process emissions from raw pet coke combustion, meeting EU BAT standards. Co-processing initiatives in Germany demonstrate 35% reduction in virgin material consumption through synthetic gas recovery from RPC residues. These innovations position raw petroleum coke as a transitional material in low-carbon industrial transitions.

(raw pet coke)

FAQS on raw pet coke

Q: What is raw pet coke?

A: Raw pet coke (petroleum coke) is a carbon-rich solid derived from oil refining. It is a byproduct of cracking crude oil and is primarily used in industrial applications like fuel or electrode production.

Q: How is raw petroleum coke different from calcined petroleum coke?

A: Raw petroleum coke is untreated and contains volatile materials, while calcined coke is heat-treated to remove impurities. Calcined coke is preferred for high-heat applications like aluminum manufacturing.

Q: What factors influence raw petroleum coke prices?

A: Prices depend on crude oil costs, refining rates, global demand, and environmental regulations. Market volatility and geopolitical factors also play a significant role in price fluctuations.

Q: Where can I buy raw pet coke?

A: Raw pet coke is typically sold by oil refineries, specialized traders, or through global commodity platforms. Buyers should verify supplier certifications and product specifications before purchasing.

Q: Why does raw petroleum coke price vary regionally?

A: Regional pricing differences arise from transportation costs, local taxes, and supply-demand imbalances. Environmental policies in certain regions may also restrict usage, affecting market dynamics.

Pervious

Pervious

Next

Next